Commodities Wrap: Rising geopolitical tensions pushed oil prices higher

Thursday 29 January, 2026

Summary

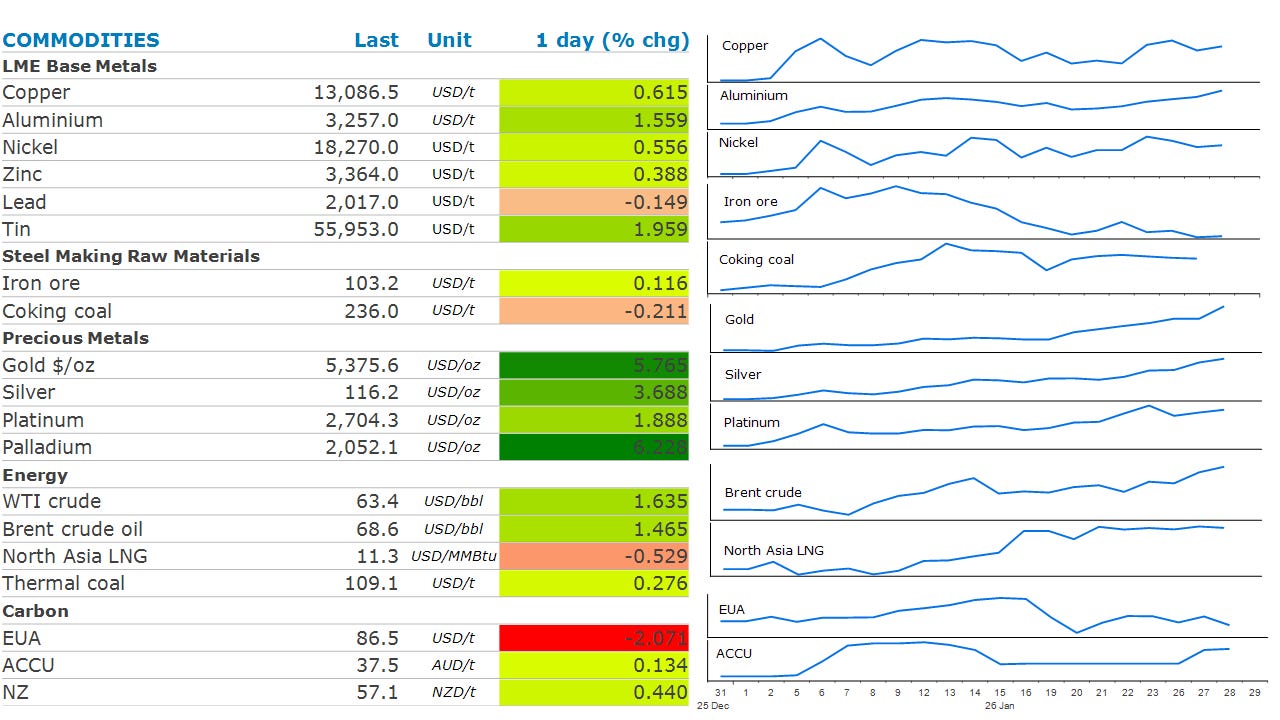

Precious metals extended recent gains amid a weaker USD. Rising geopolitical tensions pushed energy markets higher. Industrial metals were also stronger.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Economic data: Eurozone consumer confidence; New Zealand trade; ANZ business confidence; Philippines GDP; Singapore unemployment; South Africa rate decision; South Africa PPI; Sri Lanka trade; Sweden rate decision; US initial jobless claims (08:30 NY / 13:30 UK / 00:30 AEDT Fri); US trade (08:30 NY / 13:30 UK / 00:30 AEDT Fri); US factory orders (10:00 NY / 15:00 UK / 02:00 AEDT Fri); US durable goods (10:00 NY / 15:00 UK / 02:00 AEDT Fri); Ukraine rate decision.

Commodities reports: Singapore onshore oil‑product stockpiles (weekly); Insights Global weekly oil‑product inventories for ARA; EIA US natural gas inventories (10:30 NY / 15:30 UK / 02:30 AEDT Fri).

Events: Main North Sea March programs due; Hyvolution (Paris; last day); Future Power Grids 2026 (Berlin; last day); India Energy Week (through 30 Jan); Baker Hughes Annual Meeting (Florence; through 30 Jan); Handelsblatt Energy Summit 2026 (Berlin; last day); UK PM Keir Starmer visits China (through 31 Jan); EU foreign ministers meet (Brussels).

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Crude oil prices rallied to a four-month high amid rising geopolitical tensions. President Trump threatened another attack on Iran, urging Tehran to negotiate a nuclear deal. This raised the spectre of disruptions to its oil supply. This follows threats of US intervention amid a crackdown on protests in Iran earlier this month. The US has been subsequently building up its military presences in the Middle East. Inventory data also cast a relatively bullish mood across the market. Energy Information Administration’s weekly inventory report showed the US crude oil stockpiles unexpectedly fell by 2.3mbbl last week, most likely driven by the winter storm that has swept across the US. This drawdown was significantly higher than indicated by a closely watched private sector report earlier this week. The drop in the oil inventory was slightly offset by gains in refined product stockpiles. Gasoline inventories rose 223kbbl and are now at their highest level since June 2020. Distillate was up 329kbbl.

European gas prices edged lower as weather forecasts point to milder conditions. This may ease market pressure and gas prices in the short term. This was exacerbated by increasing LNG shipments to Europe. Volumes have bounced back after dropping over the weekend. Europe now relies on LNG gas imports to meet its energy needs, with a large portion coming from the US. North Asia LNG prices were also lower as rising US gas flows eased concerns of disruptions to US LNG exports. Estimated pipeline deliveries to US LNG export terminals rose on Tuesday following four consecutive days of declines. However, another storm that may hit the US next week could put power grids to the test.

Gold extended recent gains, rising above USD5,300/oz amid ongoing USD weakness and haven buying. Trump said he was not concerned about the USD’s drop in value. Some of that weakness was reversed after Treasury Secretary Bessent mentioned a strong-USD policy. The Federal Reserve’s decision to leave interest rates unchanged also failed to dampen investor demand for the precious metal. Traders were instead encouraged by reports that Rick Rieder is a leading candidate to replace Jerome Powell as Fed chair. The Blackrock executive has advocated for lower borrowing costs.

Iron ore futures fell amid concerns of rising supply. Vale said it produced 336.1mt of iron ore in 2025, its strongest iron ore output since 2019. The numbers come as the iron ore giant is investigating water overflows in two of its mines in Minas Gerais state Brazil’s rainy season. Sentiment has been tempered in recent weeks by signs of weaker demand in China. Iron ore stockpiles at Chinese ports surged to their highest level since 2022 last week, reflecting softer demand and robust supply.

The weaker USD helped boost investor appetite in the base metal markets. Copper, aluminium and other metals were also dragged along by the rally in the precious metal markets. Aluminium jumped to a four-year high amid concerns over tightness in supply. China has implemented a cap on smelter capacity and there are fears that producers in the rest of the world can’t ramp up output to feed growing demand from the energy transition.

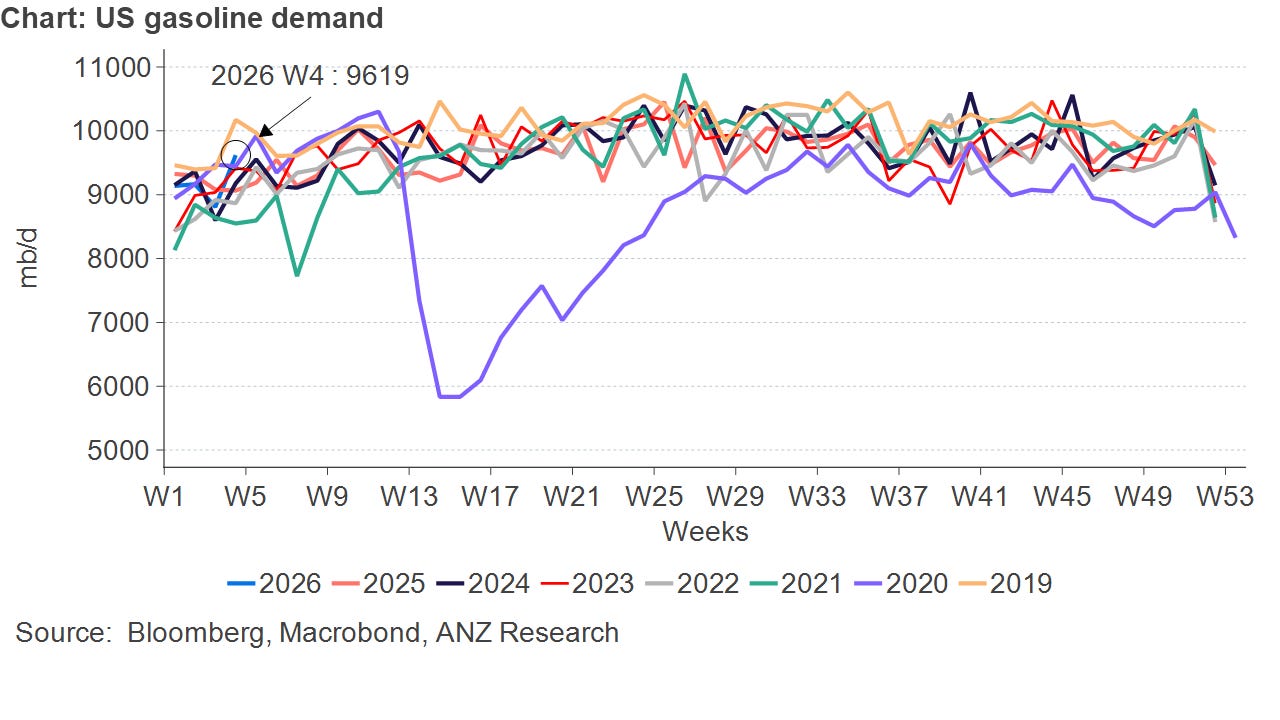

Chart of the Day

US gasoline demand jumped almost 1mb/d last week to its highest level since mid-December. On a seasonal basis, it hasn’t been this high since 2019. While some of last week’s strength is likely due to the public filling up tanks ahead of the winter storm, underlying consumption is also strong.