Commodities Wrap: Precious metals plunge as Fed independence fears subside

Monday 2 February, 2026

Summary

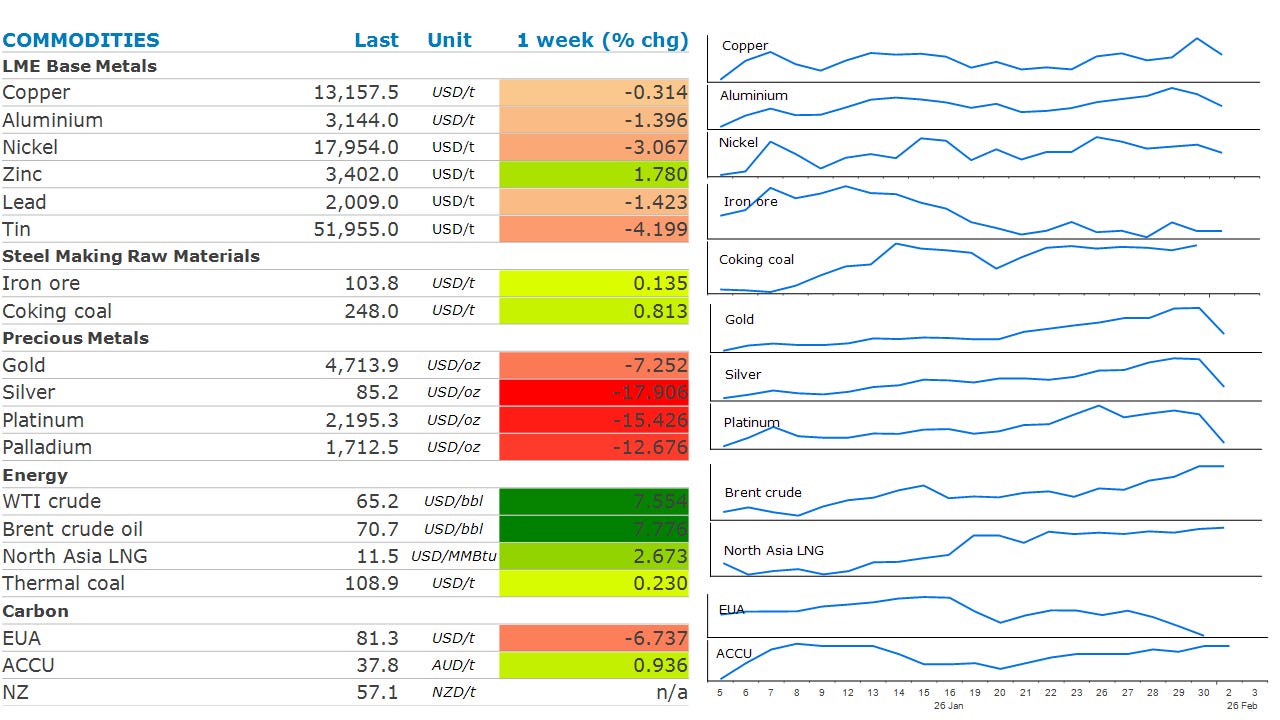

Precious metals slumped amid frenzied selling triggered by a stronger USD. Oil gained amid elevated geopolitical tensions. Industrial metals were also lower.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: Malaysia; Mexico.

Central bank speakers: Atlanta Fed President Raphael Bostic (Rotary Club of Atlanta).

Economic data: China RatingDog manufacturing PMI; Eurozone HCOB manufacturing PMI 10:00 Brussels (04:00 / 09:00 / 20:00); France HCOB manufacturing PMI; Germany HCOB manufacturing PMI; India HSBC manufacturing PMI; Indonesia CPI; Indonesia trade; Indonesia S&P Global manufacturing PMI; Japan meeting minutes; Japan S&P Global manufacturing PMI; Pakistan CPI; Serbia GDP; South Korea S&P Global manufacturing PMI; UK S&P Global manufacturing PMI; UK Nationwide house prices; US ISM manufacturing 10:00 / 15:00 / 02:00+1; US S&P Global manufacturing PMI 09:45 / 14:45 / 01:45+1.

Commodities reports: Bloomberg oil tanker trackers for January.

Events: LNG2026 Doha (through 5 Feb); Argus Americas Crude Summit Houston (through 4 Feb); Saudi Capital Markets Forum New York (through 3 Feb); WSJ Invest Live (through 3 Feb); Singapore Space Summit (through 3 Feb); Galp 4Q trading update.

Market data: LME inventories & warrants ~09:00 London (04:00 / 09:00 / 20:00); SHFE warrant changes after China close.

Metals & miners: Mitsui & Co earnings

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Gold and silver plunged after the USD jumped following news that the Trump administration was preparing to nominate Warsh as the next Fed chair. The unprecedented rally in precious metals prices has been largely driven by fears that a central bank heavily influenced by Trump would lower rates and trigger higher inflation. However, Warsh is considered the toughest on inflation among the candidates for the role, lessening the likelihood of a dramatic easing of monetary policy. This triggered a wave of selling, with gold suffering its biggest slide in four decades. Silver plunged 36%, with the intraday fall of about USD40/oz, larger than its outright price only five months ago. The moves were exacerbated by some extreme positioning in options markets, which had built up during the recent rally.

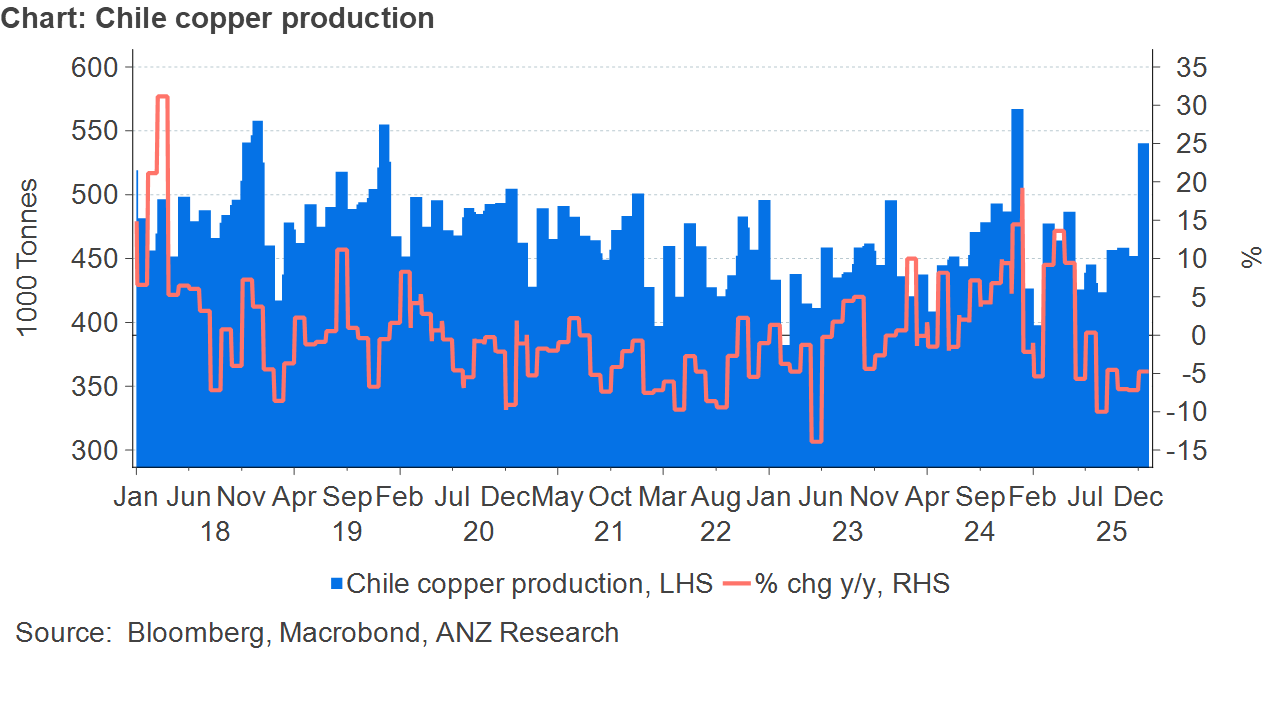

The heavy selling in the precious metal sector weighed on sentiment across the broader metals markets. Copper retreated from its record high amid frenzied trading as investors liquidated positions. Nervousness was heightened by a technical issue on the London Metal Exchange that delayed the opening of trading in Asia by an hour. Given the recent gains and the prospect of higher trading margins on Chinese exchanges, investors were happy to take profits. There were also concerns that the higher prices would induce a reaction from the physical market. This could be through more scrap hitting the market or demand loss as consumers look to other metals. However, the supply backdrop is an issue that won’t be rectified quickly. This was highlighted by data showing the world’s biggest producers continue to struggle. Chile’s output of copper in December fell by 4.7% y/y to 540.2kt, according to data from Chile’s bureau of statistics. This comes despite state-owned copper producer, Codelco, reporting an increase in output. Those gains were more than offset by losses at other companies. Antofagasta reported 2025 copper production declined 1.6% to 653.7kt.

Crude oil gained last week amid renewed geopolitical tensions. Trump ramped up pressure on Iran, warning the OPEC member that it must make a nuclear deal or face military strikes. However, it gave up some of those gains on Friday after Trump said Iran wants to make a deal. The distinct shift in his messaging has eased concerns of supply disruptions. This removed some risk premium out of the market, even as US military presence in the region continues to build. Nevertheless, tension remains high. Iran’s supreme leader warned of a “regional war” if the US were to attack. The market is also mindful of the OPEC meeting over the weekend that ended up ratifying plans to keep production steady in March, the last part of a three-month pause in production hikes. With crude oil prices hitting a four-month ahead, there were concerns it may have raised output in case of supply disruptions, but the real issue is what it will do in April when the three-month pause ends. That topic was left for its next meeting on 1 March.

Global gas markets were on edge, with colder temperatures raising concerns of stronger demand. European gas futures gained on Friday as the rapid depletion of inventories continued. Europe’s storage levels dropped to 43%, the lowest since the 2022 energy crisis. North Asia LNG prices were also higher last week.

Chart of the Day

Supply side issues in Chile remain a concern. December normally sees strong output as producers ramp up to meet strong demand from Asia. While Chilean producers managed to increase output from November, the volume achieved in December was well short of that achieved in December 2024. This is likely to be remain a concern for the market as it looks ahead to the strong demand expected from the energy transition and IT-related infrastructure boom.