Commodities Wrap: OPEC paints a balanced outlook for oil

Friday 12 December, 2025

Summary

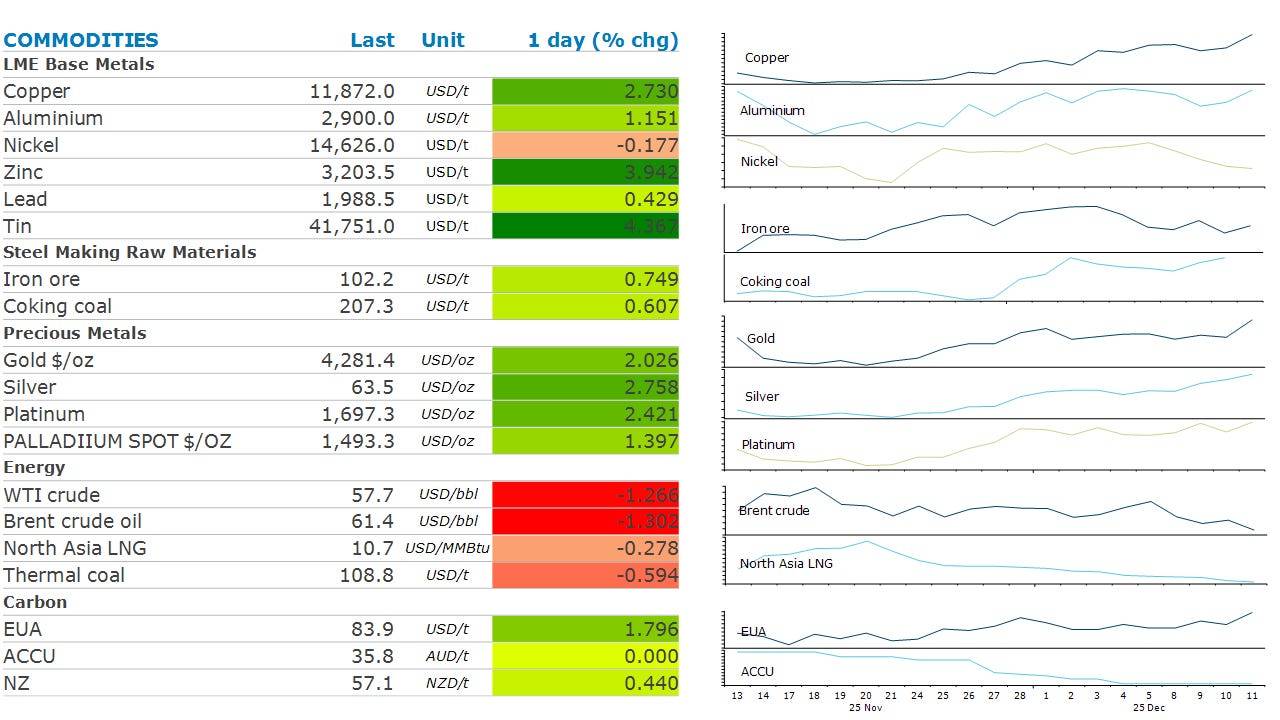

Oil fell amid a risk-off tone across markets. Copper surged to fresh highs as outlook improves. Gold and silver gained following the Fed rate cut.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: Mexico

SHFE weekly commodities inventory

China weekly iron ore port stockpiles

Baker Hughes weekly rig count

CFTC commitments of traders weekly report

Central bank speakers: Goolsbee, Hammack (Fed)

Economic data: France CPI; Germany CPI; India CPI; Japan industrial production; Malaysia industrial production; Mexico industrial production; New Zealand BusinessNZ manufacturing PMI; Russia GDP, trade; Spain CPI; Turkey current account; UK industrial production.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Crude oil extended recent losses amid a risk off tone across markets. Sentiment wasn’t helped by a more subdued outlook for the oil market. OPEC expects oil supply and demand in 2026 to be relatively balanced. This is a sharp reversal from outlooks earlier this year which pointed to tighter markets. It expects it will need to produce an average of 43mb/d next year to balance the market. Key OPEC+ nations acknowledged the fragile state of the market but announced recently that it would pause production hikes in the first quarter of 2026. This offset concerns of supply disruptions emanating from Venezuela. Earlier this week US forces intercepted and seized a sanctioned oil tanker off the coast of Venezuela. Reuters reported that the US is preparing to intercept more ships transporting Venezuelan oil. It suggests it will target ships that may have also transported oil from other countries targeted by US sanctions, such as Iran. The Office of Foreign Assets Control announced that the US Treasury Department has sanctioned another six crude oil tankers and their related companies. It marks an escalation of tension between the two countries and threatens up to 560kb/d of crude oil exports. Shippers may become reluctant to load Venezuelan cargo.

European gas managed to eke out a small gain, reversing losses from earlier in the week as traders weighed the impact of slowing LNG flows on the region’s supply balance. Imports of LNG into ports in northwest Europe and Italy have edged lower so far in December. While demand has been relatively subdued due to mild weather, the region still needs to keep supplies high. Gas storage sites are less than 72% full, compared to a five-year seasonal average of 81%. Any sudden supply disruption would see these storage facilities quickly emptied. North Asia LNG prices couldn’t follow European markets higher due to a lack of follow up buying from smaller importers that emerged earlier this week.

Copper climbed to another high, as easing monetary policy boosted sentiment. The Fed delivered a widely expected cut and upgraded its growth forecast for the US economy. It now expects growth to hit 2.3% next year, up from its previous target of 1.8%. The combination of lower interest rates and stronger economic growth should boost copper demand. This comes as new demand centres emerge. Traders remained concerned that supply may be impacted by the ongoing pull of metal into the US, driven by concerns about a US tariff on refined metal following a review of the sector.

Gold advanced, as traders shrugged off a slightly hawkish Fed. The central bank’s dot plot signalled only one more cut in 2026. Instead, traders appeared to take comfort from policymakers leaving the door open for more easing next year. Markets are still pricing in two cuts in 2026. Meanwhile silver hit a fresh record high of US64/oz. It’s gained 116% this year, as investors have looked for alternatives in the precious metal sector. This has been exacerbated by tightness in the physical market and dislocation across major trading hubs.

Iron ore futures fell despite signs of lower supply. Iron ore shipments from Australia total 7.4mt in the week of 28 November, down from 9.6mt the previous week.

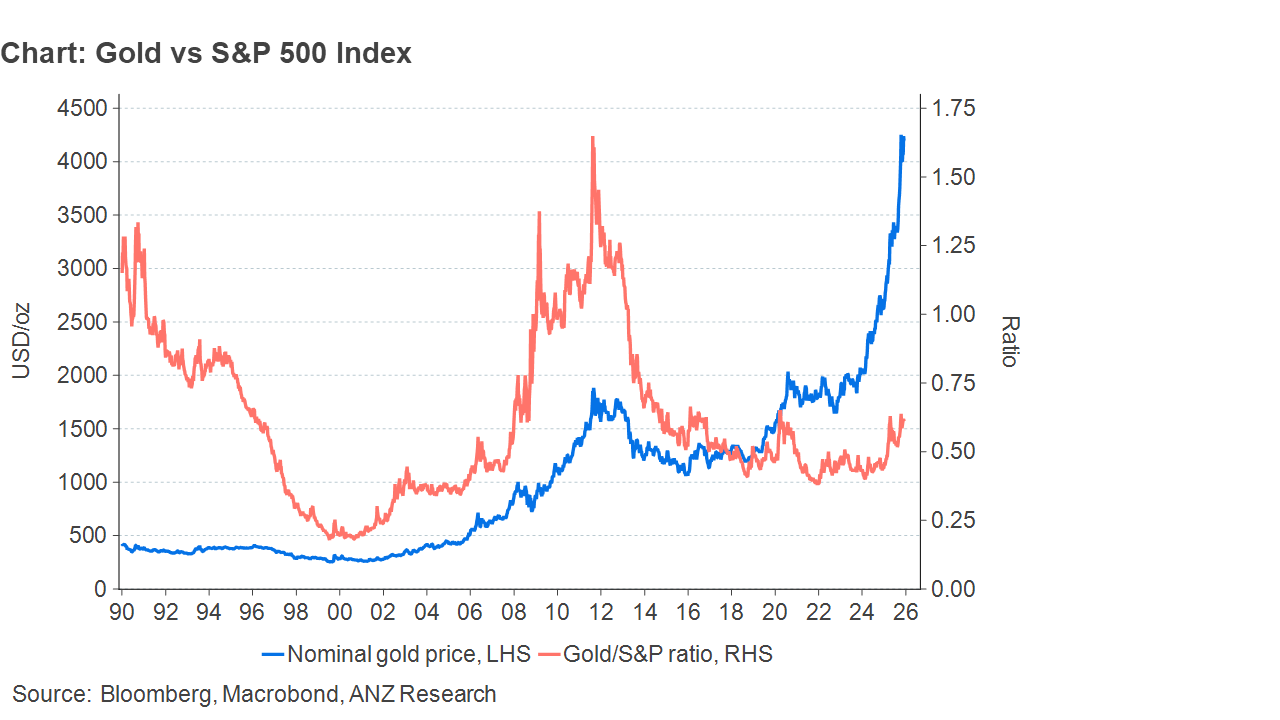

Chart of the Day

Gold is not expensive against the S&P and under owned relative to other assets. With gold prices rising 60% against 18% rise in the S&P this year, the gold-to-S&P ratio rose to 0.64, the highest since the pandemic. However, the ratio is still far from the extremes seen during 2011-2012 and prior to 2000. This implies that either S&P will have downside move or gold move further higher.