Commodities Wrap: Oil gains as Middle East tensions rise

Thursday 5 February, 2026

Summary

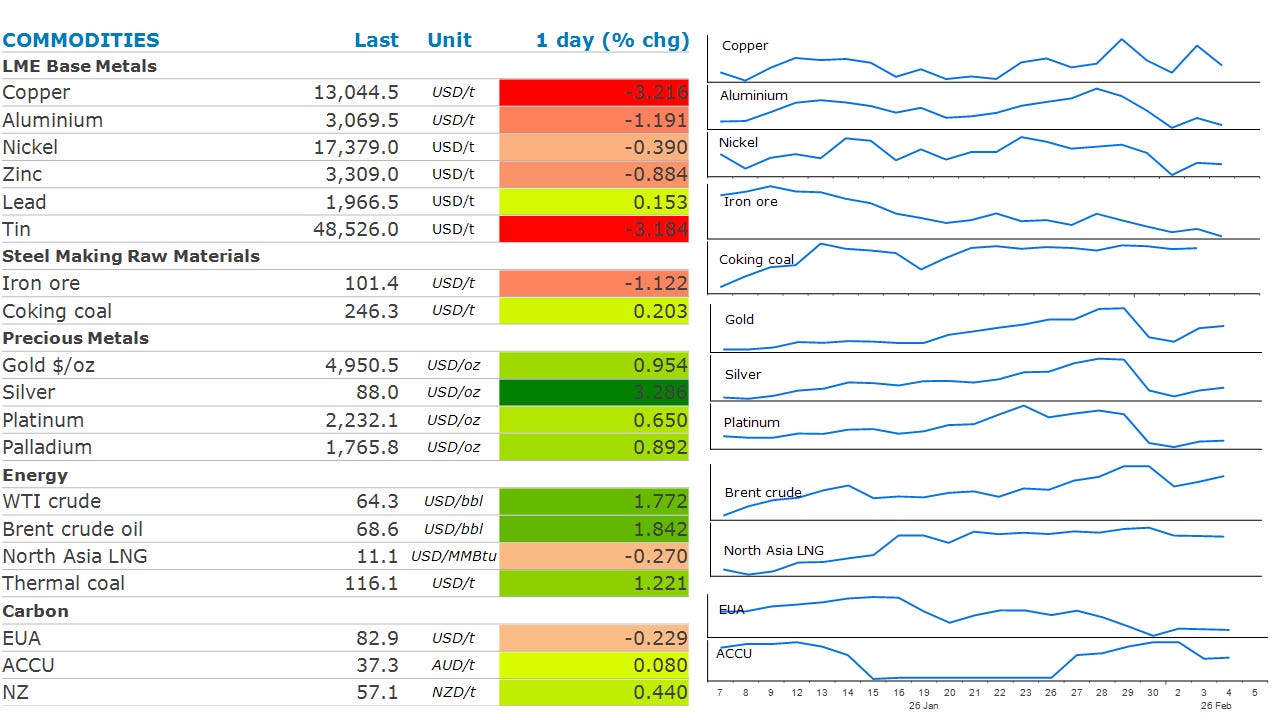

Industrial metals fell as signs of soft demand in China emerged. Precious metals also struggled to hold recent gains. Energy rose amid rising geopolitical tensions. Bulks were largely changed.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: Pakistan.

Central bank speakers: ECB President Christine Lagarde press conference; BOE Governor Andrew Bailey press conference; Bank of Canada Governor Tiff Macklem.

Economic data: Australia trade balance; Czech Republic rate decision; Czech CPI; ECB rate decision 14:15 Frankfurt (08:15 / 13:15 / 00:15+1); France industrial production; Germany factory orders; Indonesia GDP; Mexico rate decision; Philippines CPI; Singapore retail sales; Taiwan CPI; Thailand CPI; BOE rate decision 12:00 London (07:00 / 12:00 / 23:00); US initial jobless claims 08:30 / 13:30 / 00:30+1.

Commodities reports: EIA US natural gas storage 10:30 / 15:30 / 02:30+1; Singapore onshore oil product stocks (weekly); Insights Global ARA oil product inventories (weekly).

Events: LNG2026 Doha (final day); Kuwait Oil & Gas Show (final day); ICE gasoil February options expiry; Amazon and BNP Paribas earnings; Malaysia Forum Ekonomi.

Metals & miners: Nippon Steel earnings; Itochu earnings; Mitsubishi Corp earnings; Barrick earnings; Aurubis earnings; Anglo American production report.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Crude oil prices rallied as geopolitical tensions in the Middle East ratcheted up. Talks between the US and Iran hit a snag, with the White House telling Iran that it will not agree to its demands to change the location and format of talks planned for Friday. This raised concerns that the failure of diplomatic negotiations would lead to US military strikes against the OPEC member. This comes after skirmishes between the two countries earlier this week. The US shot down an Iranian drone which approached an American aircraft carrier in the Arabian Sea. This occurred shortly after a US-flagged oil tanker was halted by small armed ships in the Strait of Hormuz off Iran’s coast. Sentiment was also boosted by a drop in inventories. Energy Information Administration’s weekly inventory report showed the crude oil stockpiles fell by 3.5mbbl last week. Stockpiles at Cushing, a pricing point for WTI contracts, fell for the second straight week. The drawdowns were driven by a fall in crude oil production, which has hit the lowest since November 2024 as freezing temperatures disrupted drilling. Distillate stockpiles also fell by the most since 2021 (-5,553kbbl).

North Asia LNG prices extended recent losses on the prospect of weaker demand. China and Japan are forecast to experience milder temperatures in the coming weeks. Average nationwide temperatures across China are set to be mild, trending broadly at the seasonal average to above average through mid-February. This is likely to reduce demand for LNG used in heating and power generation. However, European natural gas futures bucked the trend to end the session higher. Traders remain concerned that the risk of a late season cold spell could boost demand. Inventories are only 40% full and another cold blast could accelerate withdrawals at a critical time.

Copper reversed early gains as the focus returned to signs of soft demand. Fresh signs emerged yesterday with inventories rising in London Metal Exchange warehouses in Asia. Supplies could be set for further gains. Copper traders pulled extra spot cargoes from Africa into the Chinese market, capitalising on a brief arbitrage window last week as a surge in Shanghai futures outpaced gains in benchmark prices in London. Weakening sentiment further was China Nonferrous Metals Industry Association forecasting that the country’s refined copper output would rise by about 5% this year, following a 10% surge last year. Copper prices briefly surged higher after the state-owned industry group called for authorities to boost strategic reserves of the metal and for Chinese manufacturers to build commercial stockpiles. This comes after the Trump administration revealed plans to build its own critical minerals strategic reserve, backed by a USD10bn fund that will procure and store the minerals for automakers, tech firms and other manufacturers. President Trump pitched prices floors for critical minerals in a bid to reduce dependence on China.

Gold struggled to hold onto yesterday’s gains amid a lack of catalysts for further buying. A stronger USD weighed on investor appetite. This offset any gains coming from rising haven buying as geopolitical tensions rise in the Middle East. Any sustainable rise in prices will likely come from the Chinese market. Physical buying had been strong in Shenzhen to stock up ahead of the Lunar New Year.

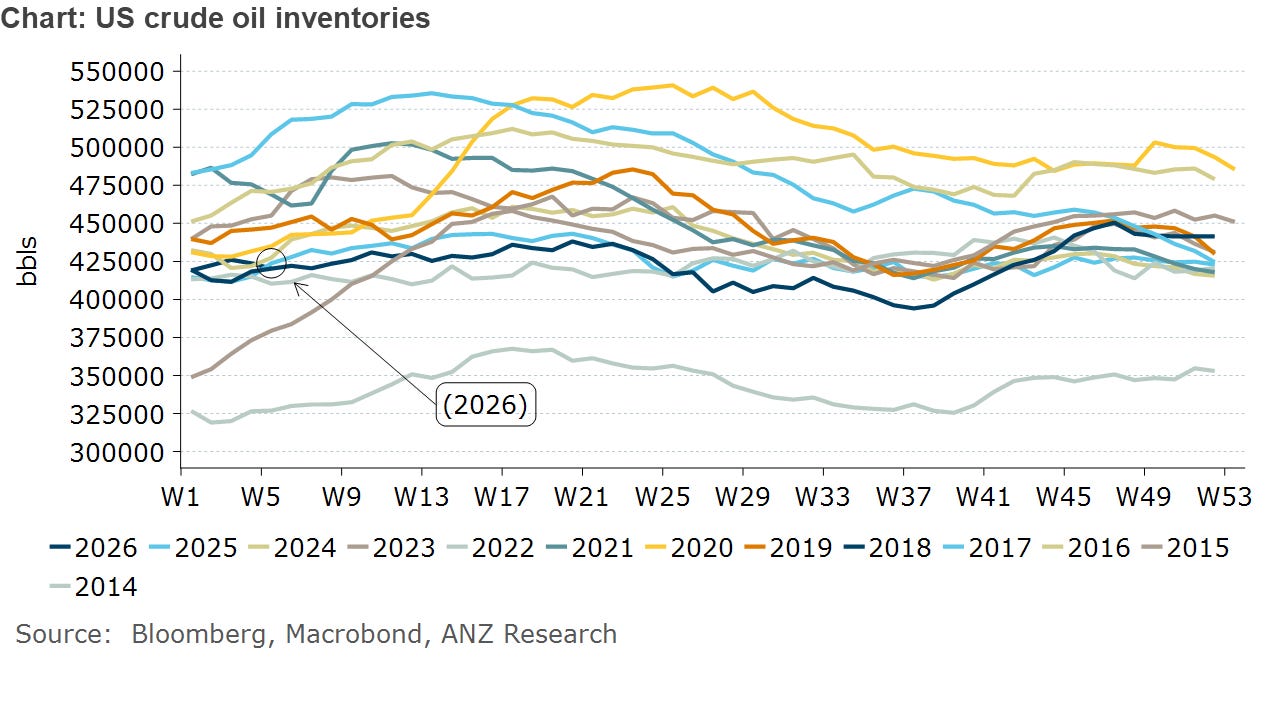

Chart of the Day

Data from today’s EIA weekly inventory report was a little noisy and showed little direction coming out of the winter storm. US crude oil inventories fell to 420.3mbbls in the week ending 30 January. This is 4% below the five year average for this time of year. However, gasoline stockpiles rose by 685kbbls. Weekly gasoline demand has been particularly volatile over the past month, probably due to fuel stations stocking up ahead of the recent storms.