Commodities Wrap: Oil gains after US seizes Venezuela oil tanker

Thursday 11 December, 2025

Summary

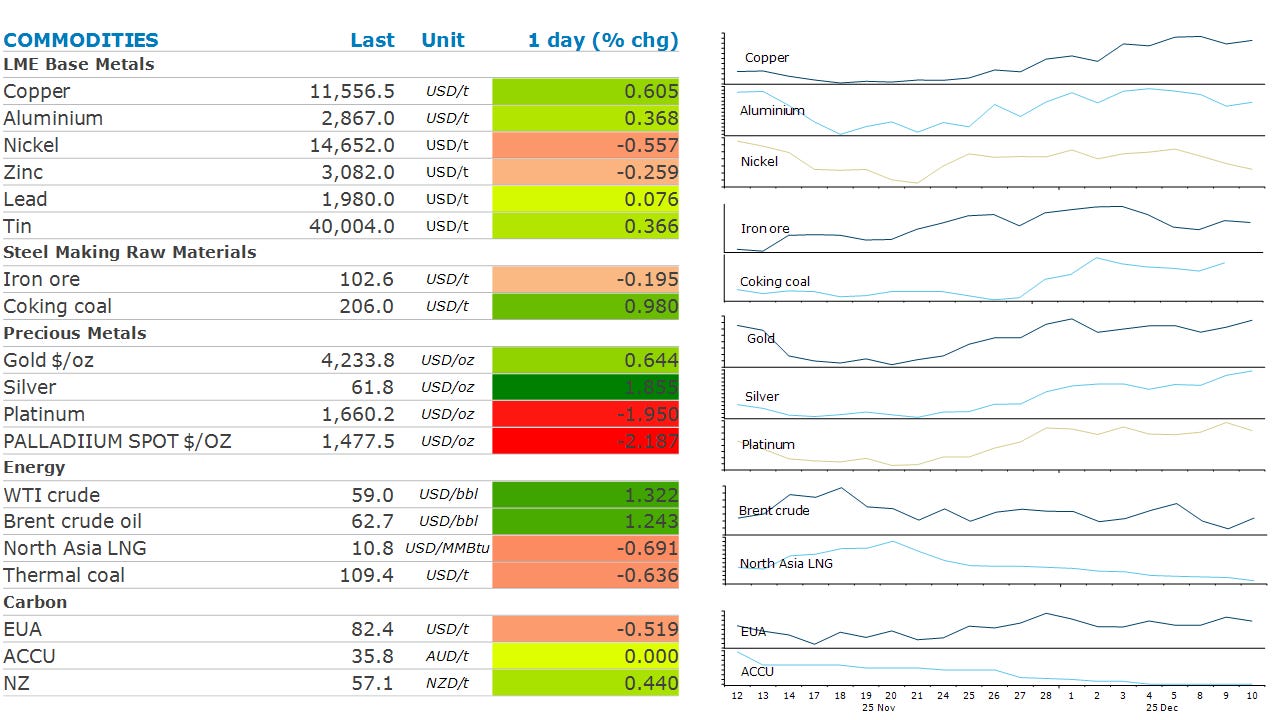

Oil gained as geopolitical tension around Venezuela rose. Industrial metals were up on hopes of stronger demand in China.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

IEA monthly oil market report

OPEC Monthly Oil Market Report

EIA weekly report on US natural gas inventories

Central bank speakers: de Guindos (ECB); Bailey (BOE)

Economic data: Argentina CPI; Australia unemployment; Israel trade; Peru rate decision; Philippines rate decision; Serbia rate decision; South Africa manufacturing production; Switzerland rate decision; Turkey rate decision; US initial jobless claims, trade balance; Ukraine rate decision

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Crude oil was under pressure in early trading on oversupply concerns. The Energy Information Administration said it expects US crude oil output to hit a record 13.61mb/d this year, despite concerns around the impact of low prices and subdued drilling activity. It estimates that global inventory will build by more than 2mb/d in 2026. However, prices erased these earlier losses after a report that US forces seized a sanctioned oil tanker off the coast of Venezuela. This marks a serious escalation of tension. China has been the biggest buyer of Venezuela’s crude in recent years, according to ship tracking data. Sentiment was also supported by an unexpected fall in US inventories. EIA data showed that US stockpiles declined by 1.8mbbl last week, the first draw on stocks in around three weeks.

European gas prices fell as persistent mild weather continues to curb fuel demand. The latest long-term seasonal weather forecasts are pointing to mild temperatures during the holiday season and through the start of next year. Easing geopolitical tensions also weighed on sentiment. Talks between the US and Europe intensified as President Trump looks to progress the US-proposed deal to end the Russia-Ukraine war. This comes as Ukraine and European allies prepare to send the US administration revised proposals for a possible peace agreement. North Asia LNG prices were also lower. However, recent losses are enticing importers such as India and Bangladesh to purchase shipments from the spot market.

Copper resumed its climb higher as traders remained concerned about tightness in the physical market. The market has shrugged off recent weak economic data in China, including fresh signs of stress in the country’s manufacturing sector with data showing producer prices fell for the 38th straight month. Instead, it remains focused on copper’s long-term prospects as use in renewables, electric vehicles and data centres accelerates. The longer-term outlook in demand comes against a backdrop of ongoing supply side issues. A series of mine disruptions this year has turned the focus onto the increasingly difficult operating conditions the mining industry finds itself in. Despite increased capital investment, state-owned copper producer Codelco continues to struggle raising output.

Iron ore futures edged lower but remained above USD100/t as China derides speculative activity. China Iron and Steel Association said the resurgence of ‘false heat’ in iron ore prices is the result of capital games and speculative trading activity. State-backed trader China Mineral Resources Group said that iron ore risks becoming detached from physical market reality, as financial speculation drives strong prices more so than underlying supply and demand.

Gold erased losses after the Fed delivered an expected 25bp cut. However, the gains were limited due to a change in the wording of its statement, which suggested greater uncertainty about when it might cut again.

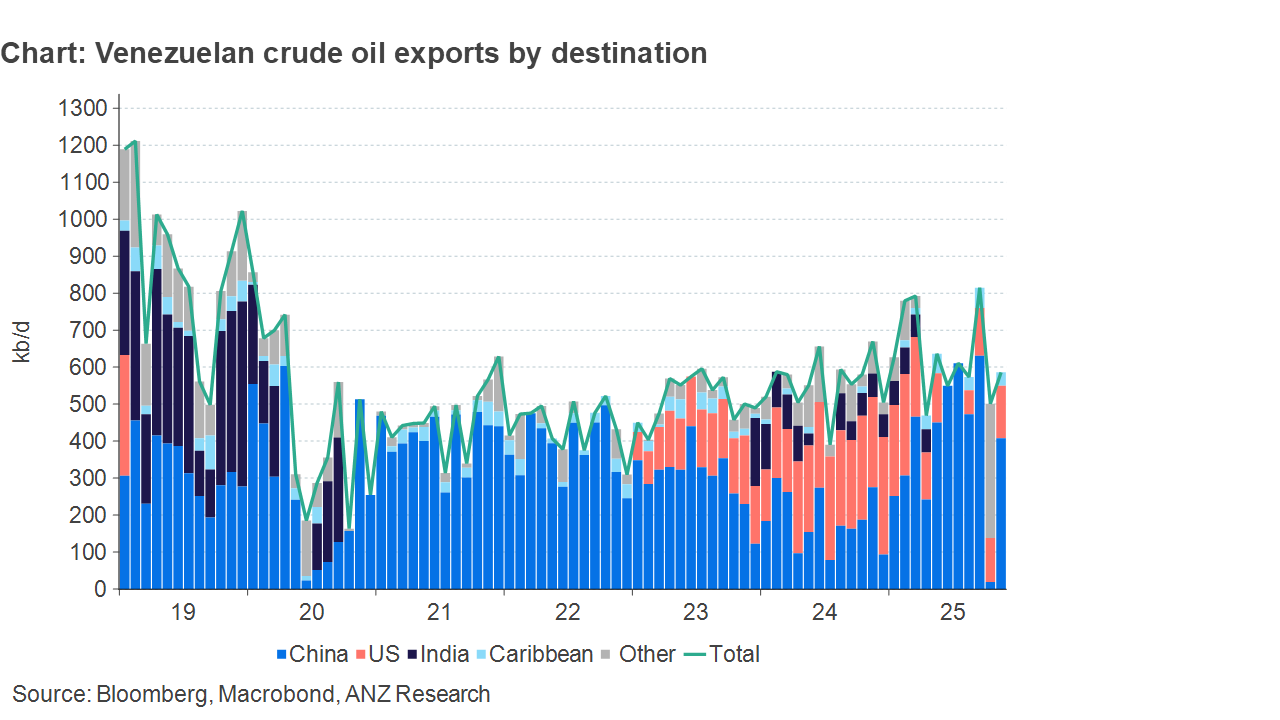

Chart of the Day

The US revoked Chevron’s oil licence to operate in Venezuela in March, citing electoral conditions and the country’s failure to take migrants from the US. Chevron was producing around 250kb/d, which constituted around 20% of Venezuela’s total production. However, Venezuela has been able to keep export levels above 600kb/d by selling more oil to China. That may be at risk following the move by the US to seize one of its oil tankers.