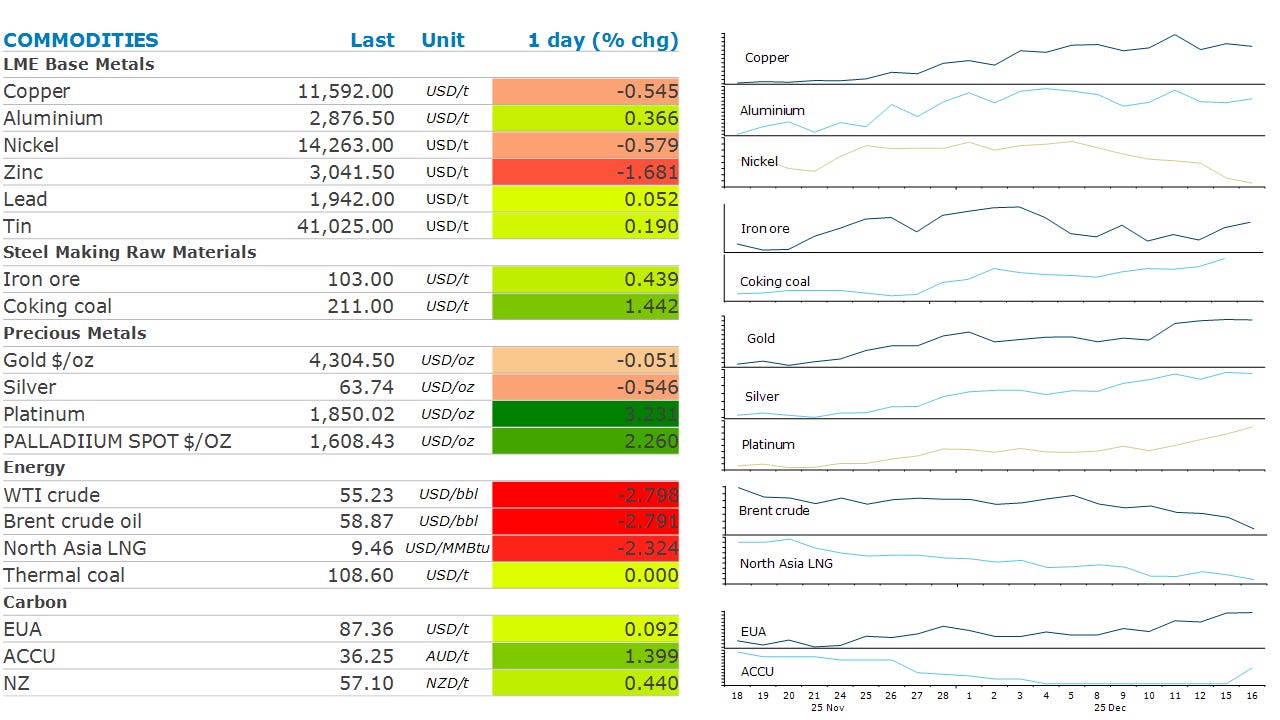

Commodities Wrap: Oil breaks below USD60/bbl amid oversupply concerns

Wednesday 17 December, 2025

Summary

A risk-off tone across markets weighed on sentiment across the commodities complex. Oil extended losses amid oversupply concerns. Gold was unchanged.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

China due to publish November output data for base metals, oil products

EIA weekly report on US oil inventories, supply and demand

CFTC weekly commitment of traders data

Central bank speakers: Williams, Bostic (Fed).

Economic data: Eurozone CPI; Germany IFO business climate; Indonesia rate decision; Japan core machinery orders, trade; Singapore trade; South Africa CPI; Thailand rate decision; UK CPI.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

The selloff deepened in the oil market, with Brent crude falling below USD60/bbl for the first time since February 2021 amid oversupply concerns. Signs of weakness have emerged in recent weeks, such as Middle Eastern spot crude prices falling below longer date futures (known as contango). The same structure has also appeared in the US Gulf Coast market. Premiums for gasoline and diesel have also eased in recent weeks. Support from supply risks is also evaporating. Earlier this week, Ukrainian President Zelensky said that there had been real progress made in peace talks with the US and an agreement may be reached soon. The end to the Russia-Ukraine war brings with it the prospect of Russian crude flowing onto a market that is already seeing rising supply from major producers such as OPEC. This is mitigating rising risks to Venezuelan supply. The US seized an oil tanker last week and positioned warships, aircraft and troops near Venezuela’s coast.

North Asia LNG prices fell to a two-year low as mild winter temperatures ease heating demand. At the same time, inventories remain near comfortable levels. Asian consumers are more sensitive than regions like Europe to weather swings, due to limited storage capacity. At the same time, new LNG supply continues to enter the market. Strong export volumes have emerged from Qatar and the US in recent months. The weakness is spreading to other gas markets, such as Europe, where benchmark natural gas futures are also under pressure. Higher-than-normal temperatures in Europe are weighing on demand. The latest weather forecasts are pointing to persistent mild temperatures during the holiday season.

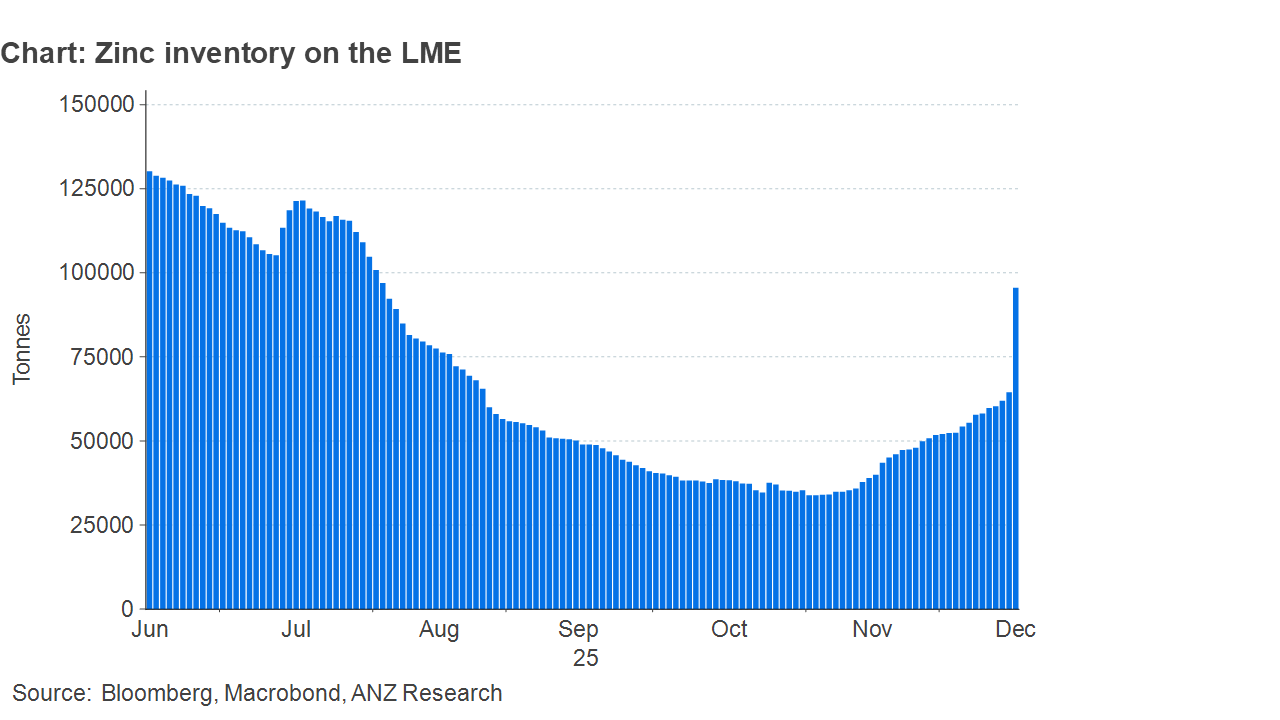

Copper edged lower amid a risk off tone across markets. Three-month futures on the London Metal Exchange fell toward USD11,600/t after strong gains on Monday. Investors were cautious heading of key US economic data. Stocks and other risk assets weakened ahead of the release. Nevertheless, the outlook for the red metal remains positive. Copper demand has been relatively strong, with China’s imports remaining elevated on strong growth from sectors such as electric vehicles and energy infrastructure. In the US, an AI-related investment boom is also boosting consumption. This comes as the market continues to fret about a possible tariff on US imports. These trade concerns continue to draw copper out of the international market and into the US. Zinc prices fell sharply amid signs the recent shortage of metal is easing. The spread between spot and 3mth futures has eased in recent days, signalling conditions for buyers have improved as inventories rebound.

Gold steadied after a five-day gain amid mixed economic data. Jobs data in the US suggests growth is sluggish, according to the Bureau of Labor Statistics. However, it wasn’t enough to lift traders’ expectations of further Fed rate cuts. The central bank is seen as less likely to put much weight on the data due to disruptions.

The resilience of iron ore prices appears to be cracking amid a barrage of weak economic data. Fundamentals weakened in recent weeks. Inventories of iron ore at Chinese ports expanded for a fifth week to the highest levels since March. Chinese steel mills are slowing output, with November volumes down 10.9% y/y to 69.87mt.

Chart of the Day

The recent tightness in the zinc physical market appears to be easing. Following several months of steady drawdowns, zinc inventories on the LME have started to build. After hitting a 12 month low of 34.1kt in early November, stockpiles climbed to 64.48kt on 15 December. That was followed by a 31kt build on 16 December, the largest tonnage increase since 16 April. The recent price gains (+20% since June) are likely to have induced hidden supplies being moved onto exchanges.