Commodities Wrap: Metals gains amid renewed supply side issues

Friday 19 December, 2025

This is the last post for 2025 before I head off for a well-earned break. Hope everyone’s enjoy the newsletter. I’ll be back in early January covering all the main issues in commodity markets.

Summary

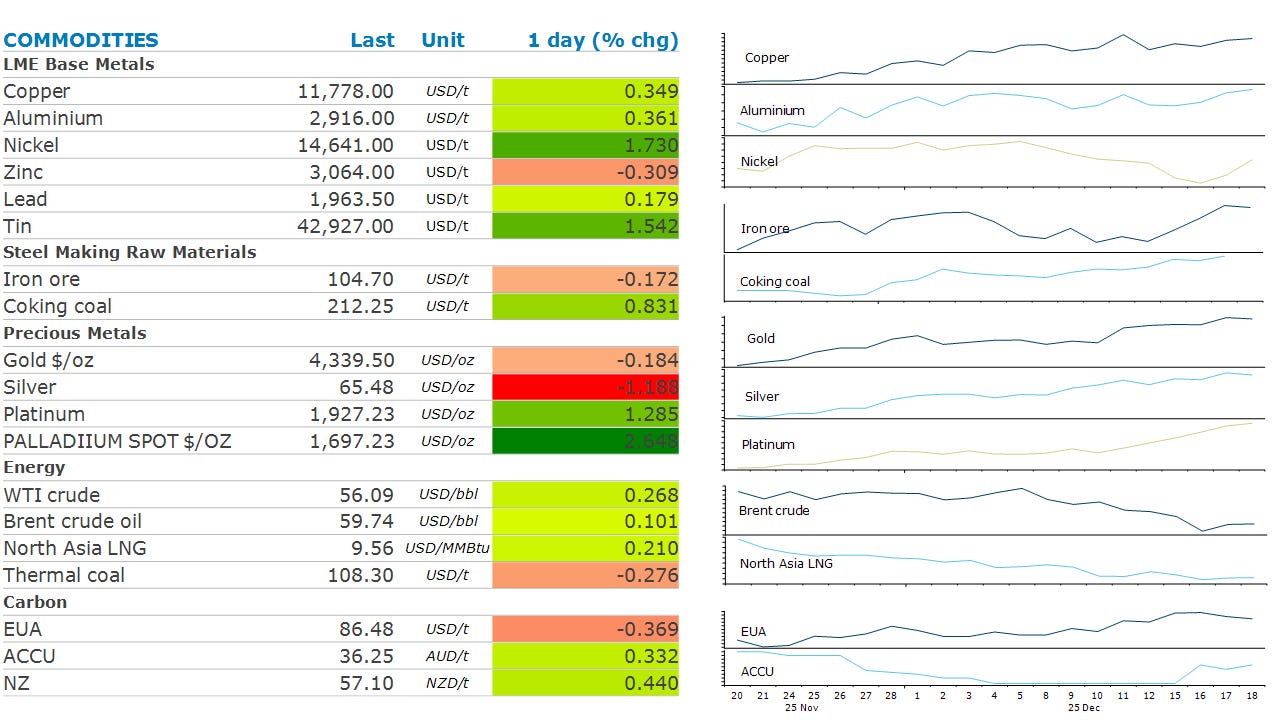

Geopolitical tensions pushed the energy sector higher. Signs of supply tightness in metal markets also provided support. Gold gained on the prospect of rate cuts.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Russian President Vladimir Putin due to hold combined annual news conference/call-in show

SHFE weekly commodities inventory

China weekly iron ore port stockpiles

Baker Hughes weekly rig count

CFTC commitments of traders weekly report

Economic data: Canada retail sales; Colombia rate decision; Eurozone consumer confidence; Japan rate decision, CPI; Malaysia trade; New Zealand trade, ANZ business confidence; Russia rate decision; UK retail sales; US existing home sales, University of Michigan consumer sentiment.

Market Commentary

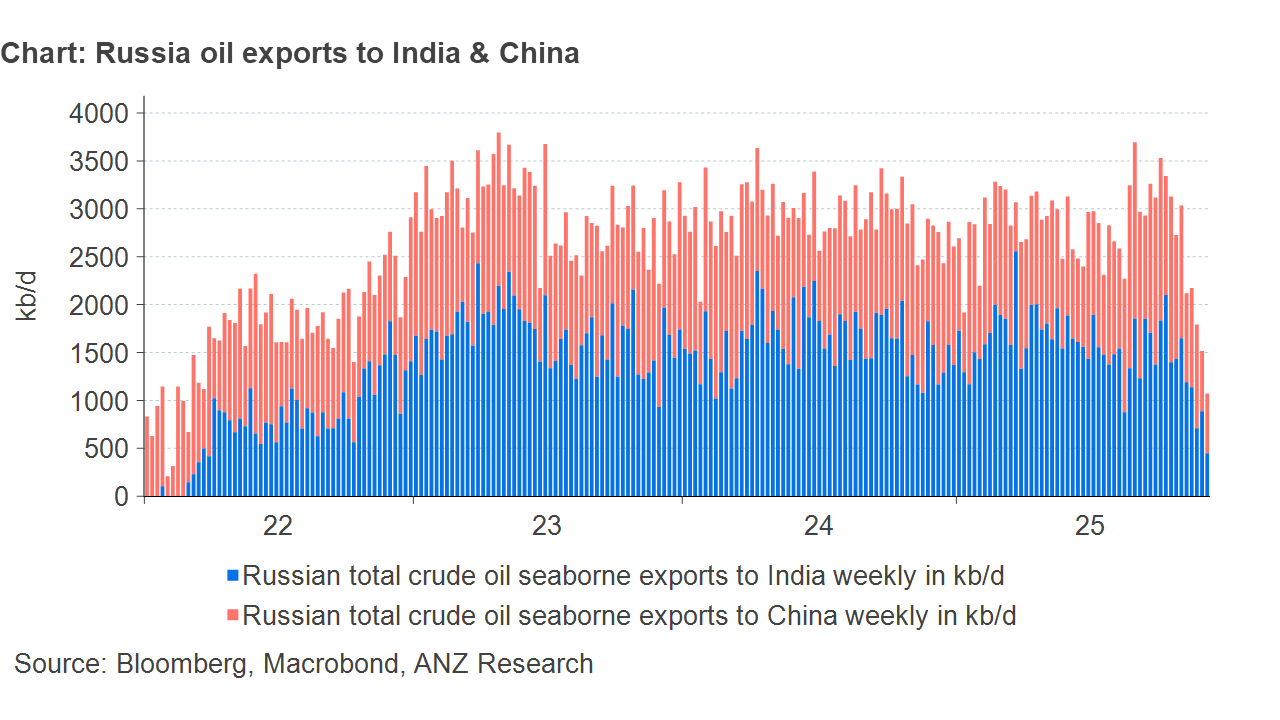

Crude oil extended gains as geopolitical tensions in Russia and Venezuela kept risks of supply disruptions high. The US has blockaded sanctioned oil tankers docking Venezuela. Oil storage facilities and oil tankers there are quickly filling, according to a Bloomberg report. Once filled, state-owned Petroleos de Venezuela SA could be forced to shut in wells. Oil companies have told the White House that they are uninterested in returning to the country in the event that President Maduro leaves. However, in a televised address today, he refrained from outlining his next moves. Supply risks are also rising in Russia. Talks to end the Russia-Ukraine war are struggling to reach agreement. This has led the US to prepare fresh sanctions on Russia’s energy sector. Current US sanctions on Russian oil companies are having an impact on oil exports, with volumes falling below 400kb/d to India and 600kb/d to China.

North Asia LNG prices edged higher as lower prices enticed buyers back into the spot market. China’s LNG imports jumped in November, customs data shows. LNG imports were 6.94mt last month, up 14% y/y. That’s the first monthly rise this year. China’s 30-day moving average for LNG imports was 231kt on 17 Dec, up 9.5% y/y according to ship tracking data. European gas also rose amid concerns over supplies. The European Parliament approved legislation to ban spot market imports of Russian LNG once the regulation comes into force in early 2026.

Gold traded near a record high after cooling US inflation boosted chances of the Fed cutting rates. Traders are now assigning a roughly 25% chance of a reduction in January and almost fully pricing one by April. A fall in yields also supported the precious metal. Meanwhile, rising geopolitical tensions appear to have enhanced gold’s appeal. Platinum rose for a sixth consecutive session as signs of tightness in the London market continue to concern traders. The one-month borrowing cost has jumped to around 14% on optimism that Chinese demand will jump after a new contract on the Guangzhou Futures Exchange started trading this week.

Copper end the session higher as investors took solace from the softer than expected US inflation data, which boosts the chance of further rate cuts by the Fed. Nickel jumped after reports that Indonesia is looking to cut nickel output. The Indonesia government’s 2026 work plan and budget proposed a big drop in nickel ore production to buoy prices, according to local media. The target for nickel production next year was proposed at about 250mt, compared with this year’s goal of 379mt. The government can control production levels by the issuance of permits, known as RKABs. Lithium prices were also stronger after China announced plans to revoke 27 expired mining permits in one of its major lithium hubs. The licences do not specifically list lithium as the resources type, but some of these resources can also contain the metal. While the cancellations will have no direct impact on lithium output, it indicates the government intends to tighten control and management of mining licences. This spurred sentiment in the lithium market.

Chart of the Day

US sanctions on Russian oil companies Rosneft and Lukoil have seen Indian and Chinese buyers baulk at purchasing their oil. After sitting around 1.4mb/d before the sanctions, imports have sharply dropped to around 400kb/d. A similar fall has also occurred in China.