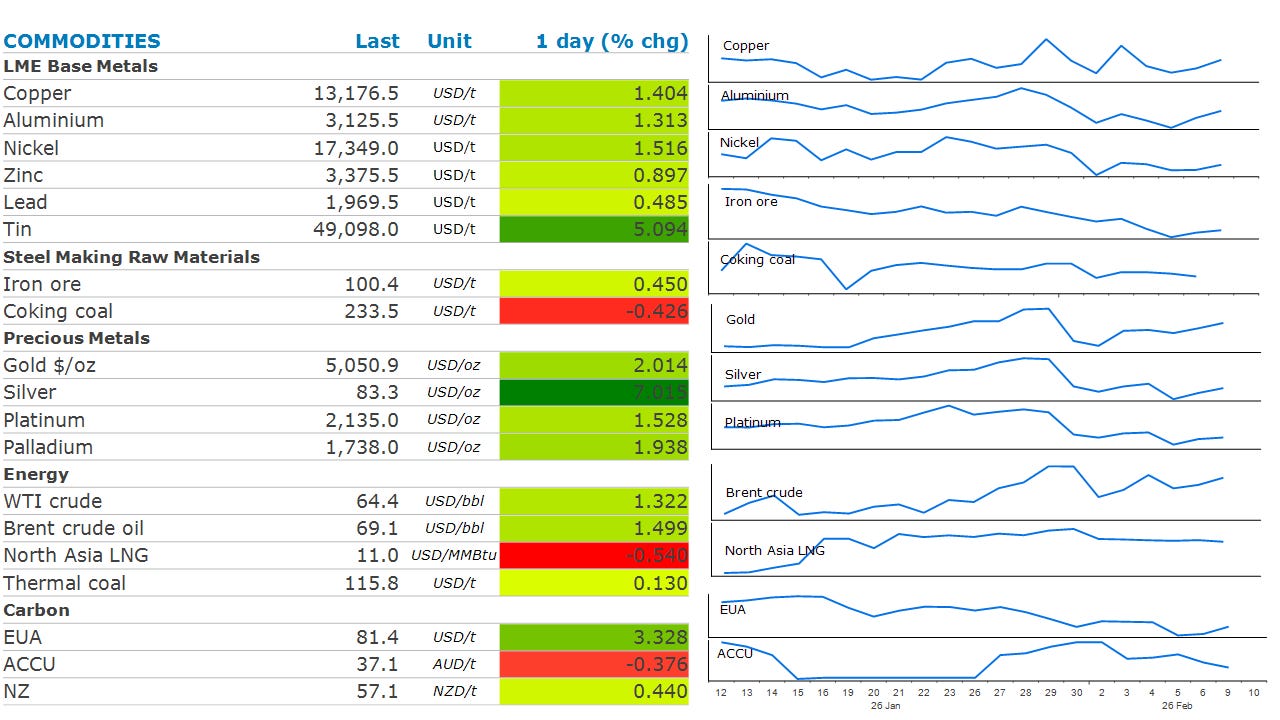

Commodities Wrap: Metals gain amid broader risk-on tone

Tuesday 10 February, 2026

Summary

A weaker USD helped boost investor appetite across the precious and industrial metal sectors. Geopolitical risks also pushed energy higher.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: Qatar.

Central bank speakers: US — Cleveland Fed Pres Beth Hammack (Ohio Bankers League); Dallas Fed Pres Lorie Logan (Asset Management Derivatives Forum).

Economic data: Australia — Westpac consumer confidence; NAB business confidence; Denmark — CPI; Japan — money stock; machine tool orders; Kenya — rate decision; Mexico — international reserves; vehicle production; Norway — CPI; Singapore — GDP; Turkey — industrial production; US — retail sales; NFIB small business optimism; employment cost index.Commodities reports: EIA Short‑Term Energy Outlook (about 12:00 NY / 17:00 UK / 04:00 AEDT+1); API — US weekly oil inventories (16:30 NY / 21:30 UK / 08:30 AEDT+1).

Events: International Energy Week, London (through 12 Feb); Oslo Energy Forum (through 12 Feb); E‑World, Essen (through 12 Feb); Consensus Hong Kong (through 12 Feb); Metals — earnings: Titan Co; First Quantum; LME commitment‑of‑traders positions.

Market data: US — ADP weekly employment change (08:15 NY / 13:15 UK / 00:15 AEDT+1).

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

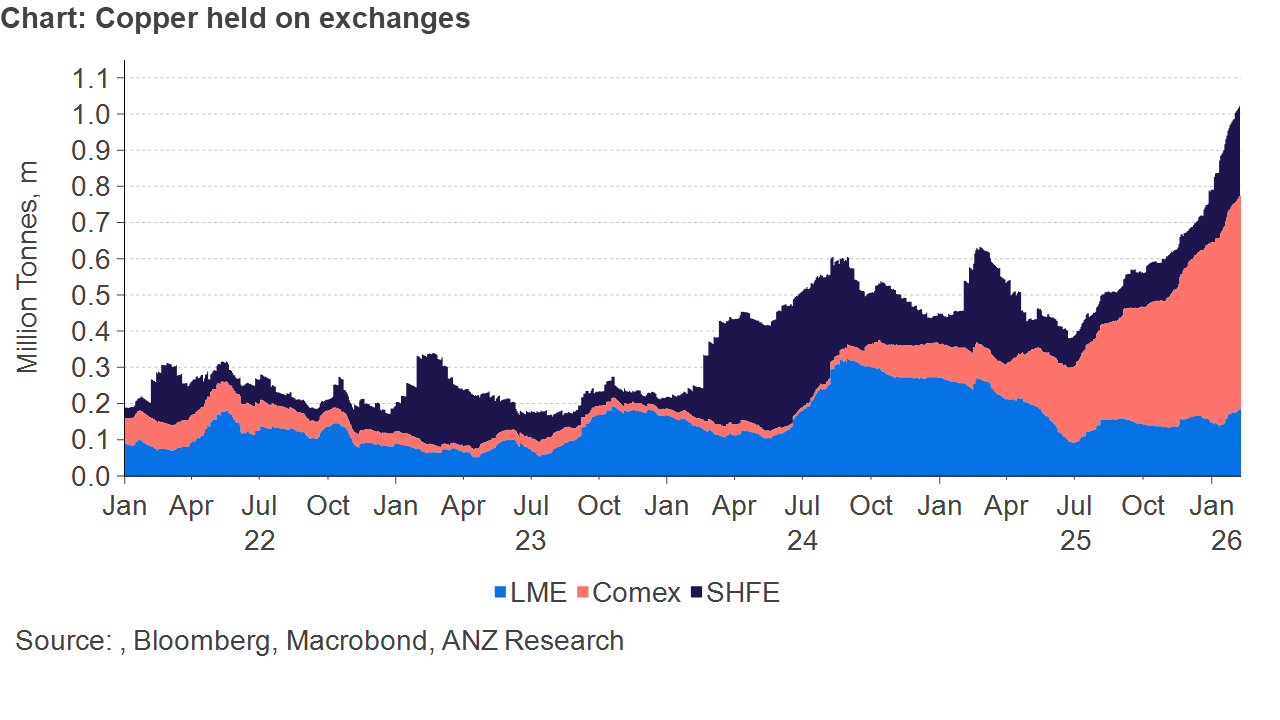

Copper led the base metal sector higher, as traders shrugged off waning Chinese demand. Instead, a broader risk-on tone across markets helped boost investor appetite. A weaker USD provided tailwinds. Sentiment was supported by supply side issues in Chile. The world’s biggest producer reported January shipments of copper rose 7.9% y/y to USD4.55bn. However, average prices surged 34% in that period and the volume of copper shipped was lower. This underscores the issues facing Chile’s copper industry. Falling grades and increasingly difficult operating conditions are making it hard to maintain output at current levels, let alone increase them to meet rising demand. The market is facing the prospect of a large US stockpile that is unavailable to the market. Fears that President Trump will impose tariffs on refined copper have seen metal held in COMEX warehouses rise to 589kt as of 6 February. Metal held off-exchange could double the stockpile. Initially the market assumed that the US copper stockpile would flood the market once tariff concerns eased. However, Trump’s plans to create a USD12bn stockpile of critical minerals could see large amounts of metal remain unavailable.

The weaker USD tempted investors to dip back into gold. Bullion rose by as much as 1.8% on Monday, recovering some ground after an historic selloff at the end of last month. Data over the weekend showed the recent selloff didn’t deter central bank buying. The People’s Bank of China extended its gold-buying to 15 months in January, adding another 40koz to its reserves. Buying from Chinese investors may remain relatively strong. Regulators have advised financial institutions to rein in their holdings of US Treasuries, citing concerns over concentration risks and market volatility, according to a Bloomberg report.

Iron ore futures in Singapore edged back above USD100/t despite easing supply issues. Western Australia’s Port Hedland resumed operations as Tropical Cyclone Mitchell headed south. Other ports are likely to do the same over the next 24 hours. Hope of Chinese stimulus measures later this quarter that would support demand boosted sentiment.

Crude oil prices gained amid rising geopolitical tensions. The US Department of Transportation said in a maritime advisory that American-flagged ships should stay as far away as possible from Iranian waters. The agency cited an incident in which Iran’s Islamic Revolutionary Guard Corps harassed a US-flagged tanker as it was transiting through the Strait of Hormuz last week. This raised concerns that talks between the US and Iran are breaking down and thus lifting the risk of military action, which could disrupt oil supplies in the region. Traders were also watching Indian flows. The country’s imports of Russian oil are expected to drop by about half from already lower levels recently, due to pressure from the US, according to a Bloomberg report.

European natural gas prices fell sharply as weather models point to warmer conditions across most of the continent in coming days. This eased concerns of supply tightness amid low gas storage levels. The outlook of warmer weather weighed on sentiment in the Asian LNG market, with North Asia LNG prices pushed lower.

Chart of the Day

Copper trade flows have been upended by Trump’s tariffs. Metal held on exchanges has subsequently risen as consumers look to secure supplies. Copper held in US Comex warehouses now represents more than 58% of global exchange inventory.