Commodities Wrap: Metals cool as China looks to curb speculative trading

Monday 19 January, 2026

Summary

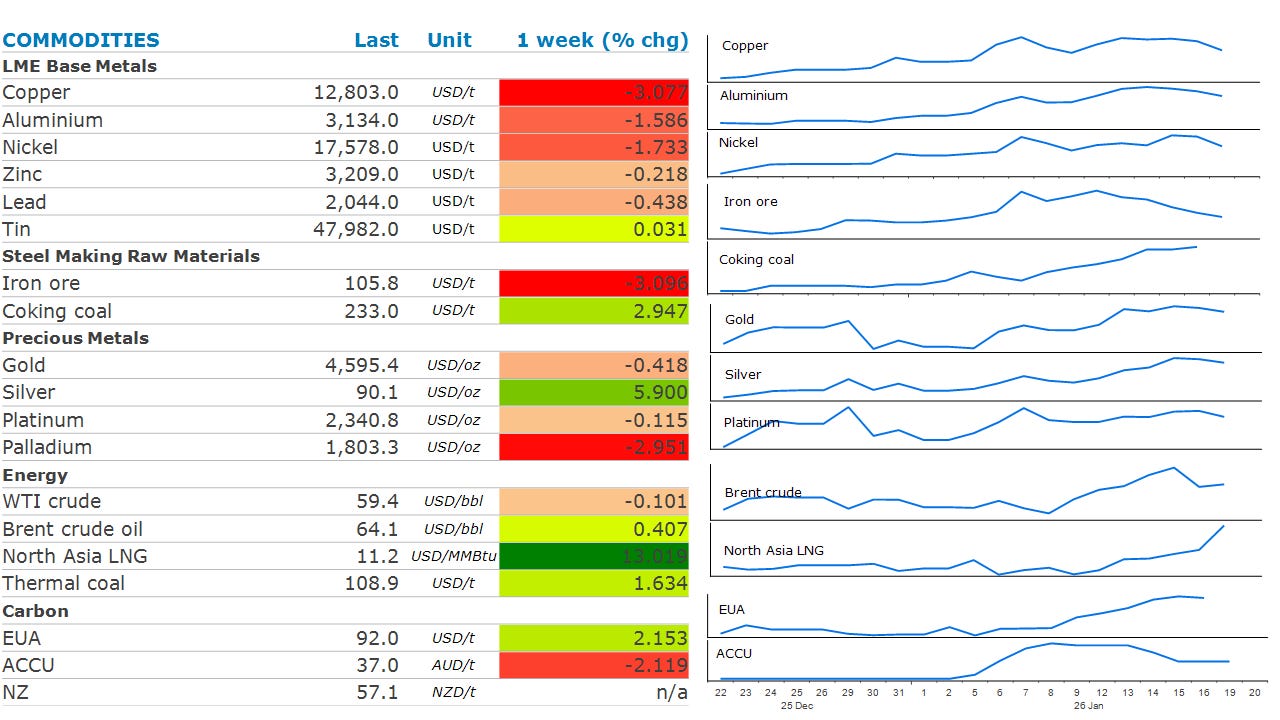

Metals cooled amid concerns of increasing regulatory issues in China. Energy was higher amid elevated geopolitical risks. Haven demand also pushed gold higher.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: US Martin Luther King Jr. Day (markets closed; reports delayed); Venezuela holiday

Economic data: China GDP; China retail sales; China industrial production; China fixed‑assets investment; Eurozone CPI (11:00 Brussels); Canada CPI; Israel central bank meeting minutes; Japan machinery orders; Japan industrial production; Japan tertiary industry index; Philippines balance of payments; Romania rate decision

Events: World Economic Forum (Davos) continues (through 23 Jan); Bloomberg House Davos (through 22 Jan); Euro‑area finance ministers meet to pick ECB vice‑president nominee; NZ PM State of the Nation address; Vietnam Communist Party National Congress (through 25 Jan)

Market data: WTI February futures expiry; CME schedule adjustments; ICE schedule adjustments

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Base metals ended the week on a sour note, as regulatory issues threatened to halt investor exuberance. A wave of buying from Chinese investors and traders has helped list copper and the rest of the base metals sector this year. However, on Friday, regulators ordered exchanges, including the Shanghai Futures Exchange, to remove servers operated by high-frequency traders from their data centres. Sentiment wasn’t helped by renewed trade concerns. President Trump announced a 10% tariff on goods from eight European countries starting 1 February, rising to 25% in June, unless there’s a deal for the purchase of Greenland. Trade data also showed that China’s rare earth exports fell in December from previous months. Moreover, China is now looking to implement tighter export controls for Japan. Exporters are now required to submit documents with more detailed information. This follows a move earlier this year to ban the export of items with potential military use. Tin bucked to trend to end the week higher, as a military-led crackdown on illegal mining in Indonesia’s main tin mining region squeezed supply. Nickel’s losses were tempered by the prospect of lower output from Indonesia, with regulators planning to significantly reduce mining quotas this year to help support the market.

Iron ore futures in China fell last week as rising supply weighed on sentiment. China received its first shipment of iron ore from the giant Simandou mine in Guinea in West Africa. The new project is expected to raise output to as much as 120mt of high-grade iron ore, which is highly sort after by Chinese steel mills. Rising inventories were also a concern. Latest data shows iron ore stockpiles at 35 major Chinese ports increased week on week, according to Steelhome data.

Gold gave up earlier gains following reports that Trump has doubts about nominating Kevin Hassett for the Fed chair role. Hassett has been viewed as a relatively dovish contender to succeed Chair Powell. Economic data last week also raised concerns about future rate cuts. Inflation and unemployment numbers came in better than expected, which led several Fed governors to signal a willingness to pause rate cuts at the next policy meeting.

Crude oil had a volatile week, on elevated geopolitical risks. Brent crude started the week with strong gains, as unrest in Iran threaten to disrupt oil supplies. However, those concerns ebbed after Trump appeared to pour cold water over the idea of US intervention. Nevertheless, geopolitical tensions remain high. The US continues to boost its military presence in the Middle East. At least one aircraft carrier is moving to the region. The US Treasury department announced sanctions on Iran’s Secretary of the Supreme National Security Council and 18 individuals and entities of what it says is a shadow bank network. Elsewhere, US forces seized another oil tanker near Venezuela, as part of a quarantine on the sale of sanctioned oil.

North Asia LNG spot prices rallied last week as a forecast of cold weather threatens to drive up spot purchases by Japan and Korea. China would also see stronger demand, with temperatures across Beijing and Shanghai expected to plunge by 20°C this week.

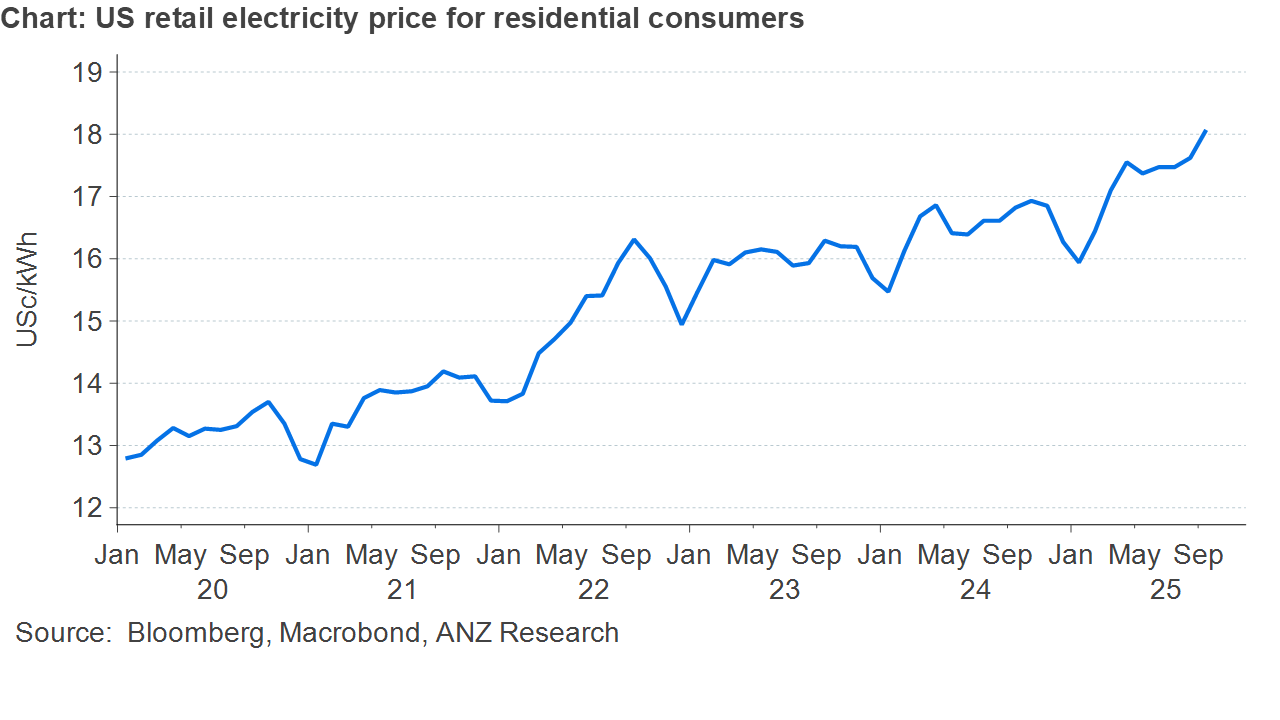

Chart of the Day

US electricity prices continues to rise as an ageing network struggles to meet stronger demand. The replacement of old equipment, and rebuilding following storms have weighed on utility costs. Upward pressure on costs is only likely to increase as the huge build out puts more pressure on the US electricity grid.