Commodities Wrap: Gold rebounds as investors reaffirm bullish outlook

Monday 9 February, 2026

Summary

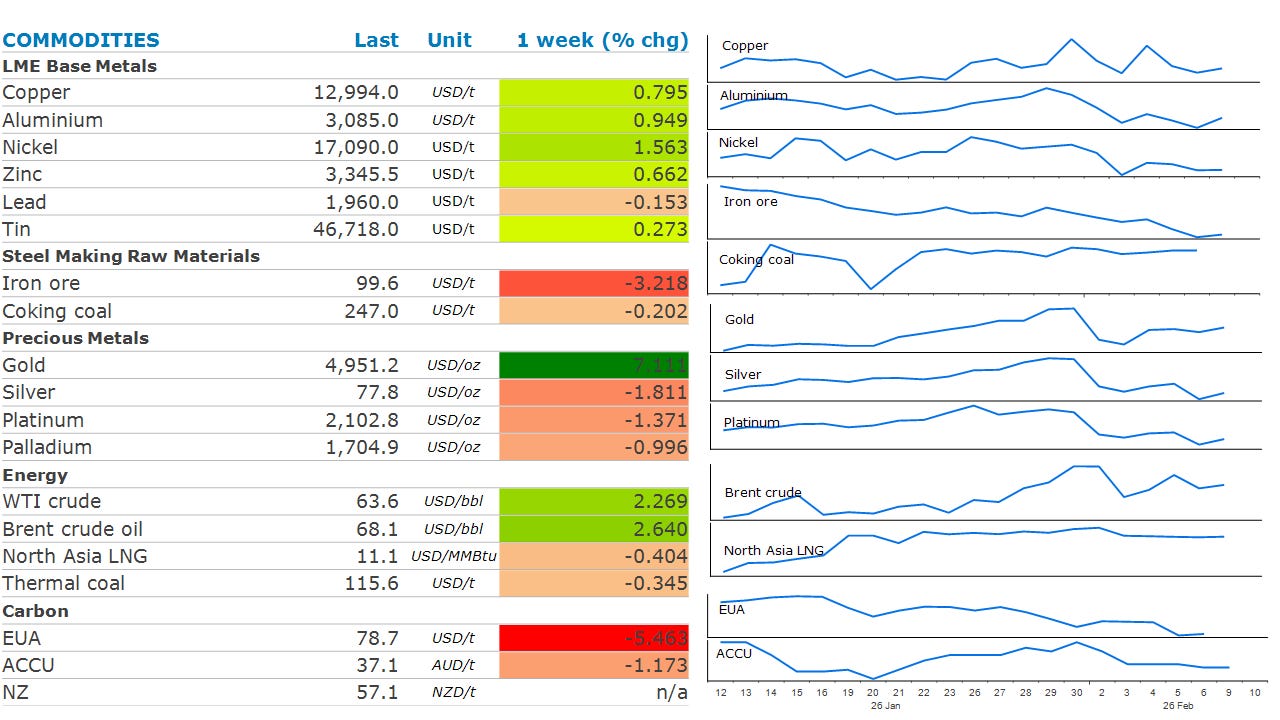

Precious metals gained amid renewed buying. Geopolitical risks pushed energy higher. Industrial metals remain weighed down by concerns over demand.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Central bank speakers: US — Fed Gov Christopher Waller (GIC, San Diego); Atlanta Fed Pres Raphael Bostic (Pro Farmer); Fed Gov Stephen Miran (Boston University, plus WBUR podcast); ECB — President Christine Lagarde (EU Parliament, Strasbourg), Chief Economist Philip Lane (Maynooth University), Governing Council members Gediminas Šimkus (Vilnius) and Joachim Nagel (Karlsruhe).

Economic data: Japan — labour cash earnings; balance of payments; Malaysia — industrial production; Mexico — CPI; Norway — GDP, PPI; Taiwan — trade; Uganda — rate decision.

Commodities reports: —

Events: Mining Indaba, Cape Town (through 12 Feb); Palm & Lauric Oils Price Outlook Conference, Kuala Lumpur (through 11 Feb); Metals — earnings: Sumitomo Metal; Cleveland‑Cliffs; China — YTD aggregate financing & money supply from this date.Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Gold ended the week higher, as investors reasserted their long-term bullish views on the precious metal. Large institutional investors still consider gold an attractive investment despite the recent selloff. That also appeared to be the view of the People’s Bank of China. The central bank extended its gold-buying to 15 months in January. The recent volatility also attracted the attention of the Trump administration. Treasury Secretary Bessent cited Chinese traders as the reason behind last week’s wild swings. Silver failed to track gold higher, with extreme volatility keeping longer term investors on the sidelines.

Copper trimmed some losses on Friday but ended the week lower on signs of weaker demand in China. Many copper plants are scheduled to take longer breaks from production over the coming Lunar New Year holiday due to recent volatility, according to a survey by local consultancy SMM. Exchange stockpiles in London, New York and Shanghai all recorded sharp rises over the course of the week. The subsequent concerns over demand were somewhat alleviated by news that the State Grid Corp of China increased fixed asset investment by 35% to CNY30.8bn in January on ultra-high voltage grids and pumped storage power stations. Aluminium was also weighed down by concerns of weaker demand. That was offset by ongoing constraints on Chinese supply after the industry hit its mandated capacity limits.

Iron ore fell below USD100/t as demand in China slowed ahead of the Lunar New Year holiday. Stockpiles at Chinese ports have been building in recent weeks as the industry enters the seasonal shutdown period. This comes as exporters such as Australia and Brazil have been boosting supply. Brazilian miner Vale SA announced last week that it delivered 336.1mt of iron ore in 2025, a record level. However, supply concerns may be on traders’ minds this week as a cyclone off the coast of Australia forces the closure of all major iron ore ports. This is the first major disruption this year, following a particularly active cyclone season in 2024-25.

Geopolitical issues continue to hang over the crude oil market. Oil gained marginally on Friday after Iran stood by its refusal to end enrichment of nuclear fuel, which has been a major sticking point for the US. Talks between the two sides failed to produce any meaningful advancement toward a deal. Oil prices also found some support on Friday from data that showed US consumer sentiment unexpectedly improved to the highest in six months. This calmed concerns over an economic slowdown which would hurt oil demand.

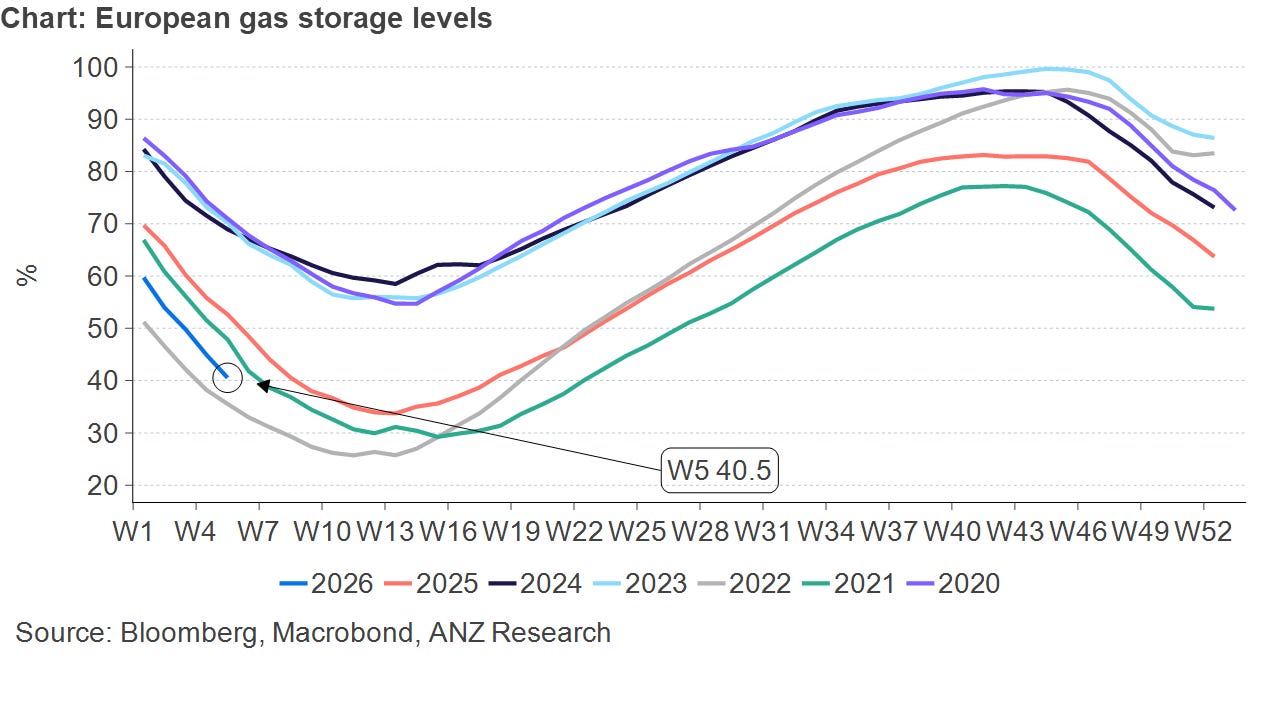

North Asia LNG prices pushed higher late last week as pockets of demand emerged. Buyers from Vietnam, Japan and India were active following recent declines in the spot market. China has experienced a sharp fall in temperatures as cold rain and snow sweep across the country. This could boost demand. European natural gas ended the week on a positive note, as a looming cold spell is also set to lift demand. Weather forecasts show cold conditions spreading in northwest Europe in mid-February. This comes as storage levels have slipped to 38%, versus a five-year seasonal average of 56%.

Chart of the Day

The European natural gas market remains on edge. Natural gas storage levels are at only 40.5%, which places it near the bottom of the range over the past six years. The saving grace being there is a surplus of LNG cargoes at the moment. The other issues in that long term weather forecasts are pointing to milder than normal temperatures for the rest of the heating season.