Commodities Wrap: Gold & silver surge amid macro uncertainty

Tuesday 27 January, 2026

Summary

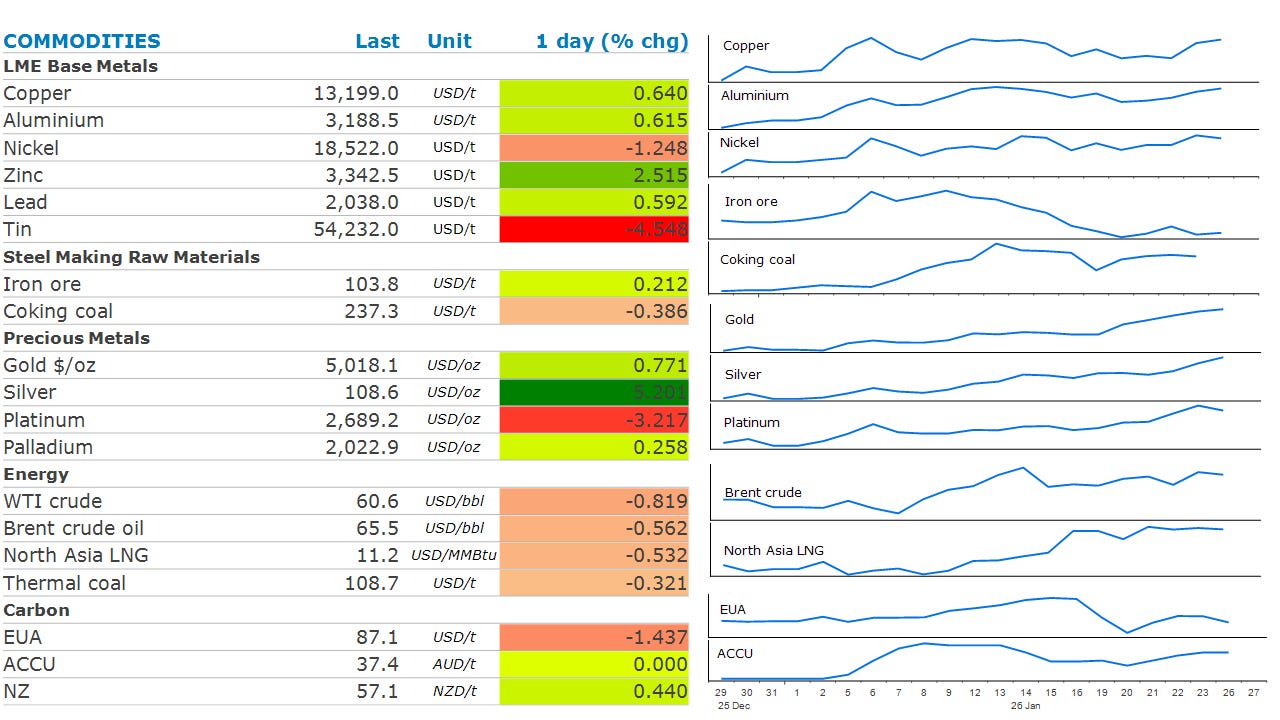

Precious metals markets surged amid strong investor demand. A weaker USD helped boost investor appetite for industrial metals. Oil prices were steady amid ongoing risks to supply.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Economic data: Chile rate decision; China industrial profits; Hong Kong trade; Hungary rate decision; Mexico trade & international reserves; Philippines trade; US Conference Board consumer confidence; Richmond Fed manufacturing.

Commodities reports: Vale production report; API weekly US oil inventories (16:30 NY / 21:30 UK / 08:30 AEDT Wed).

Events: Commodity Trading Week APAC (Singapore; through 28 Jan); India Energy Week (Goa; through 30 Jan); Hyvolution (Paris; through 29 Jan); Handelsblatt Energy Summit 2026 (Berlin; through 29 Jan); EU–India summit (New Delhi); Goldman Sachs Macro Conference (Hong Kong; through 28 Jan); BNEF Summit San Francisco (last day); Brent March options expire; Earnings: NextEra Energy (4Q, FY).

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

The unprecedented rally in the precious metals sector gained momentum. Gold broke through the USD5000/oz level while silver recorded its biggest one-day gain to a record USD117/oz. A massive sell-off in the Japanese bond market last week triggered the most recent rally. This was exacerbated this week after it was reported that the US may help Japan support the yen. Such coordinated intervention has not occurred since 2011, instilling greater concern in markets. Worries over US Federal Reserve independence have also generated strong demand for alternative safe haven assets. With geopolitical, political, economic and financial risks at their highest in decades, the investment case for gold has broadened across investor types (retail, institutional and central banks) and regions, with countries such as China and India actively promoting gold investment. Silver’s gains have been so strong that retail investors in Turkey are willing to pay as much as USD9/oz above global benchmark prices in London to get their hands on it.

A weaker USD also helped boost investor appetite in the base metals sector. However, gains were limited amid some concerns that the sharp price rises are not fully aligned with underlying fundamentals. Stockpiles of copper in Shanghai Futures Exchange warehouses rose last week to their highest seasonal level on record, suggesting demand has been soft. The prospect of a regulatory crackdown in China also tempered enthusiasm for metals. The SFE announced restrictions on positions in the tin market for some clients suspected of not properly disclosing their ultimate ownership. Therefore, investors will be subject to one-month limits on opening new positions. This saw tin futures fall more than 6% in London. The rapid rise in prices across the sector could also see margin requirements raised in other metal contracts.

Crude oil prices ended the session relatively unchanged as traders took stock of a multitude of issues impacting fundamentals. A winter storm in the US is likely to spur increased heating demand amid snow, ice and freezing temperatures. It is also raising concerns about disruptions to energy supply, with refineries struggling to operate in the conditions. At the same time, risks to supply disruptions eased elsewhere. A key Black Sea oil terminal that accounts for most of Kazakhstan’s exports has been brought back into service. Output from the country’s giant Tengiz oil field is also set to restart shortly. However, supply risks haven’t totally evaporated. Tension in the Middle East persists after President Trump dispatched naval assets to the region.

Global gas markets remained on edge as falling temperatures across several regions raise the spectre of stronger demand. US natural gas futures rose more than 40% as freezing weather swept across the country. The winter storm is also estimated to have knocked offline around 12% of US natural gas production. This could impact US exports of LNG, with pipeline deliveries to export terminals falling to their lowest level in year. This comes as consumption across parts of Europe and Asia rises amid persistently cold temperatures. Gas-fired power generation in Tokyo has risen to its highest level since March 2024. However, the gains were limited by relatively high levels of inventories, particularly in Asia.

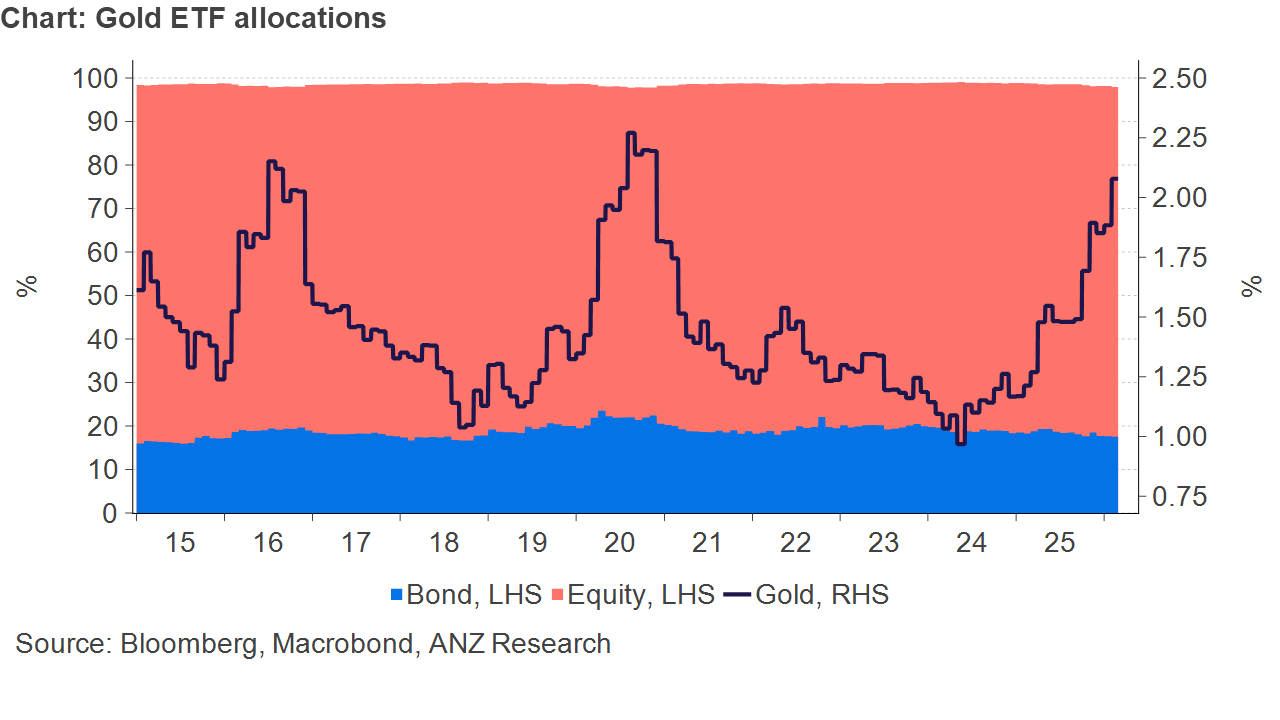

Chart of the Day

Despite the strong investor demand in recent months, gold is still relatively under-owned against traditional assets. Gold ETF assets under management make up only 2% of a portfolio made up of bonds, equities and precious metals. That provides some potential upside to investor demand, despite the strong price gains achieved recently.