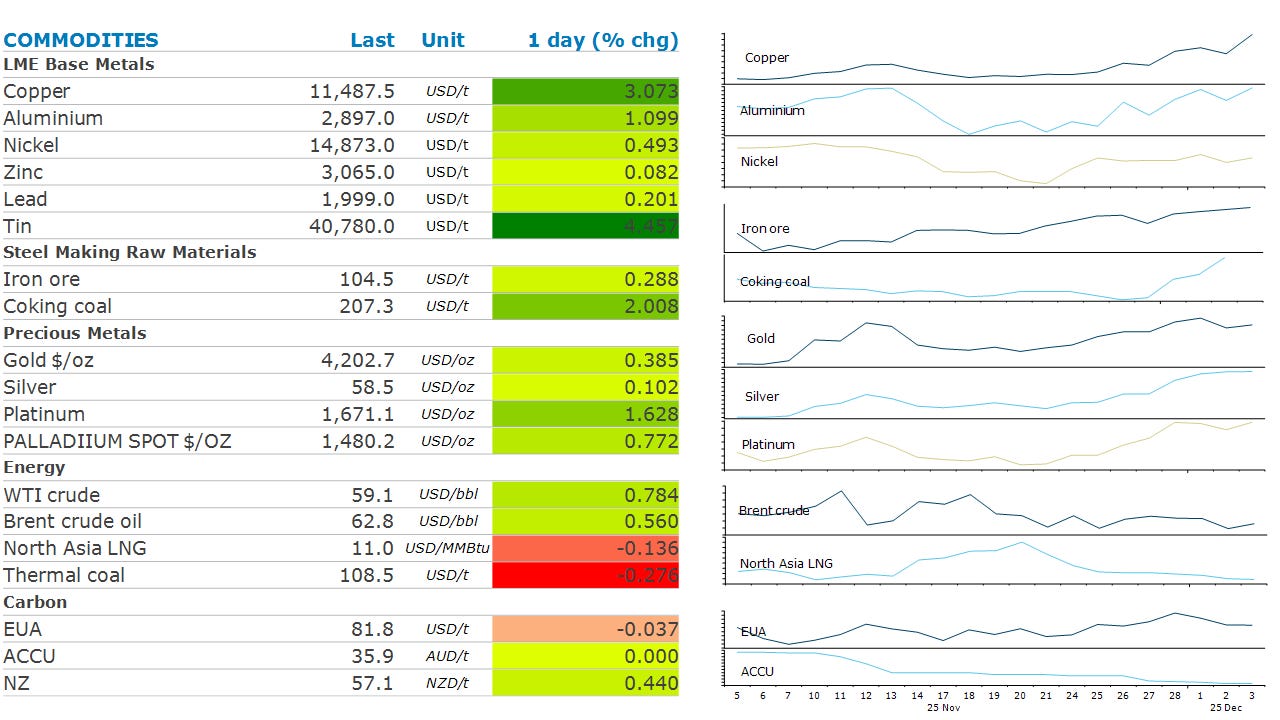

Commodities Wrap: Copper surges as supply shortages persist

Thursday 4 December, 2025

Summary

Concerns of supply shortages bolstered copper and the industrial metals sector. Little progress in Russian peace talks saw oil prices gain. Precious metals were also higher amid rising expectations of a rate cut.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Rio Tinto capital markets day

EIA weekly report on US natural gas inventories

Central bank speakers: Cipollone, Lane, Kocher (ECB).

Economic data: Australia trade; Brazil GDP, trade; Eurozone retail sales; South Africa current account; Sweden CPI; US initial jobless claims.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Copper surged more than 3% as concerns of supply shortages rose to new levels. Data from the London Metal Exchange showed a spike in orders to withdraw copper from its warehouses in Asia. The request equated to 56,875t, the biggest tonnage increase since 2013. This comes amid concerns that the US will announce levies on refined copper in 2026. This has seen traders start to accumulate metal and send it to the US before any prospective tariff is introduced. Concerns about shortages were compounded by ongoing mine disruptions. Ivanhoe Mines Ltd trimmed the outlook for production from its large Kamoa-Kakula complex in the Democratic Republic of Congo as it recovers from flooding earlier this year. Glencore Plc, which has seen a 40% drop in output since 2018, also cut its target for next year. These supply constraints have boosted copper to record highs, despite tepid demand growth.

Gold rose during the session after US payroll data reinforced expectations that the Fed will cut interest rates. US companies shed payroll in November by the most since early 2023, adding to concerns the weakness in labour markets is more pronounced than expected. Silver gained from concerns about tightness. This has seen a record volume of metal flowing into London last month. Holdings by silver-backed exchange traded funds rose by about 200t on Tuesday, according to Bloomberg data. That took total holdings to their highest level since 2022. Shortages are emerging elsewhere, including the Shanghai Futures Exchange where inventories have shrunk to the lowest in a decade.

Iron ore futures slid as fresh supply hit the market. The first commercial shipment from the Simandou mine in Guinea is on its way to China, marking a shift in global supply. The mine is set to become one of the world’s biggest iron ore mines, with a ramp up schedule that will see it reach full capacity in only 2½ years.

Crude oil gained as talks between Russia and Ukraine fail to deliver a peace deal. The Kremlin said President Putin held useful talks with US representatives Steve Witkoff and Jared Kushner, though a compromise hasn’t yet been reached on the critical issues of territorial control. The talks were set against a backdrop of increasing attacks on Russian tankers. Over the past week, four have been attacked, marking an uptick in strikes on its shipping industry. Ship owners have pulled back on sending vessels to the country. Oil’s gains were aided by data that showed a smaller than expected build in US stockpiles. The Energy Information Administration’s weekly inventory report said commercial crude oil inventories rose by 574kbbl last week, significantly less than an industry report earlier in the week which showed stockpiles rose by 2.5mbbl.

European gas futures gained after the EU agreed to a full ban on imports of Russian gas, due to come into effect in autumn 2027, with earlier phase outs for LNG and short-term supply contracts. Despite pipeline gas supplies from Russia dwindling to almost nothing, Europe has continued to buy Russian LNG cargoes. The gains were also supported by a lack of progress in peace talks between Russia and Ukraine. North Asia LNG struggled to follow European price higher amid concerns about soft demand from some of the region’s biggest importers.

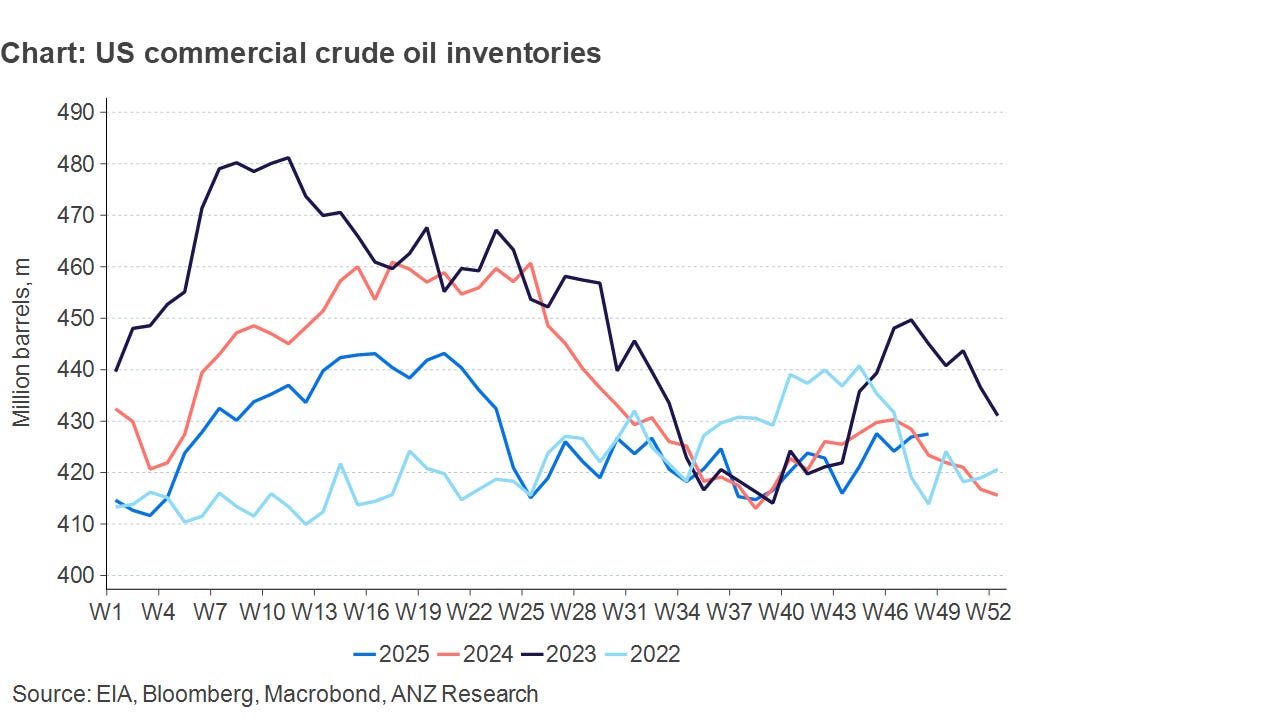

Chart of the Day

US commercial crude inventories are tracking lower than in the last two years. This is being driven by strong exports. However, refinery runs are now the highest since the tail end of the summer. Over the past five weeks, runs rose by 1.65mb/d. As a percentage of capacity, runs are at the highest seasonal level since 2022. All suggests demand is relatively robust.