Commodities Wrap: Copper supported by strong fundamentals

Monday 15 December, 2025

Summary

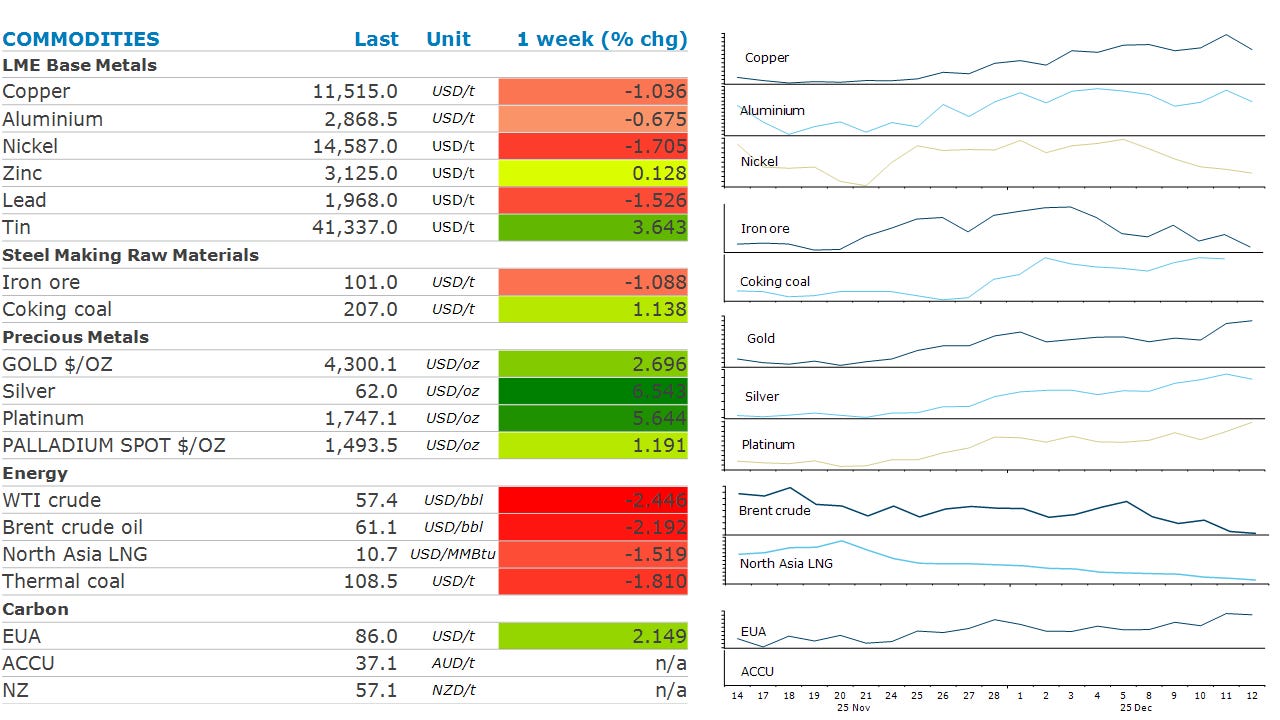

Precious metals gained, as rate cuts boosted investor demand. Industrial metals suffered from a risk-off tone across markets. Oil fell amid over supply concerns.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

China industrial output for November including coal, gas and power generation; crude oil and refining.

CFTC weekly commitment of traders data

Central bank speakers: Williams, Miran (Fed); Brischetto (RBA).

Economic data: Canada CPI, housing starts; China retail sales, industrial production; Colombia industrial production, retail sales; Eurozone industrial production; Finland CPI; India wholesale prices, trade; Israel CPI, unemployment; Japan tertiary industry index, Tankan index; Nigeria CPI; Pakistan rate decision; Poland CPI, trade; Saudi Arabia CPI; Sri Lanka GDP; US empire manufacturing.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

A risk-off tone across markets weighed on sentiment across the base metals complex, with copper giving up gains achieved earlier in the week. It fell more than 3% on Friday, as a selloff in AI focused stocks triggered profit taking by investors. Nevertheless, this is unlikely to derail copper’s ascent on strong fundamentals. Renewed supply disruptions this year have triggered a rally in copper and other base metals. However, the length of the rally suggests there is more to this than just supply disruptions. Demand continues to beat expectations, despite concerns over the global economy and the fall in China’s economic growth. China’s imports of copper have remained elevated, as growth from sectors such as electric vehicles and energy infrastructure have mitigated the weak manufacturing and property sectors. US demand has also been strong, as AI-related investment booms and trade tensions ease. Tightness in the copper market has been exacerbated by a spate of mine disruptions in 2025. However, previous supply shocks over the past 20 years have on average seen prices pullback from the initial spike by 8%. In the cases where the pullback in prices was minimal, the market was already tight due to strong demand. And we think the current demand dynamics are on par with or stronger than those instances. We are bullish on copper and expect the market to move further into deficit in 2026.

Iron ore futures fell after China moved to limit steel exports. A licensing system will be set up for certain steel products, according to the Ministry of Commerce and the General Administration of Customs. China’s steel producers have been looking to international markets amid weak domestic demand. Steel exports are up 7.3% in the first 11 months of the year and on track to reach 118mt in 2025. Any slowdown in exports will weigh on iron ore demand. This could be exacerbated by moves to make stockpiling iron ore at port less attractive. China’s state backed iron ore buyer, China Mineral Resources Group, has asked authorities to raise storage costs. The idea is to make it harder for traders to hold iron ore at ports for lengthy periods, reducing their ability to impact supply and influence prices.

Gold ended the week higher amid signs of further easing ahead. The Fed announced that it would begin buying USD40bn of Treasury bills per month from 12 December. This comes after the central bank cut rates by 25bp at last week’s FOMC meeting. However, hawkish comments from policymakers Beth Hammack and Jeff Schmid saw gold pare some of the gains late on Friday.

Crude oil also fell as weakness in US equity markets added to bearish sentiment about oversupply. This was only partly offset by geopolitical tensions. President Trump announced new sanctions on three of Venezuelan President Maduro’s nephews as well as six oil tankers, after the US seized a supertanker off the coast of Venezuela last week. Until this latest escalation, Venezuela had been raising its oil exports. Bloomberg data shows it had loaded almost 880kb/d so far in December, up from an average of 586kb/d in November. The market is also facing increased tensions between Russia and Ukraine, despite the US still pushing for a peace deal.

Chart of the Day

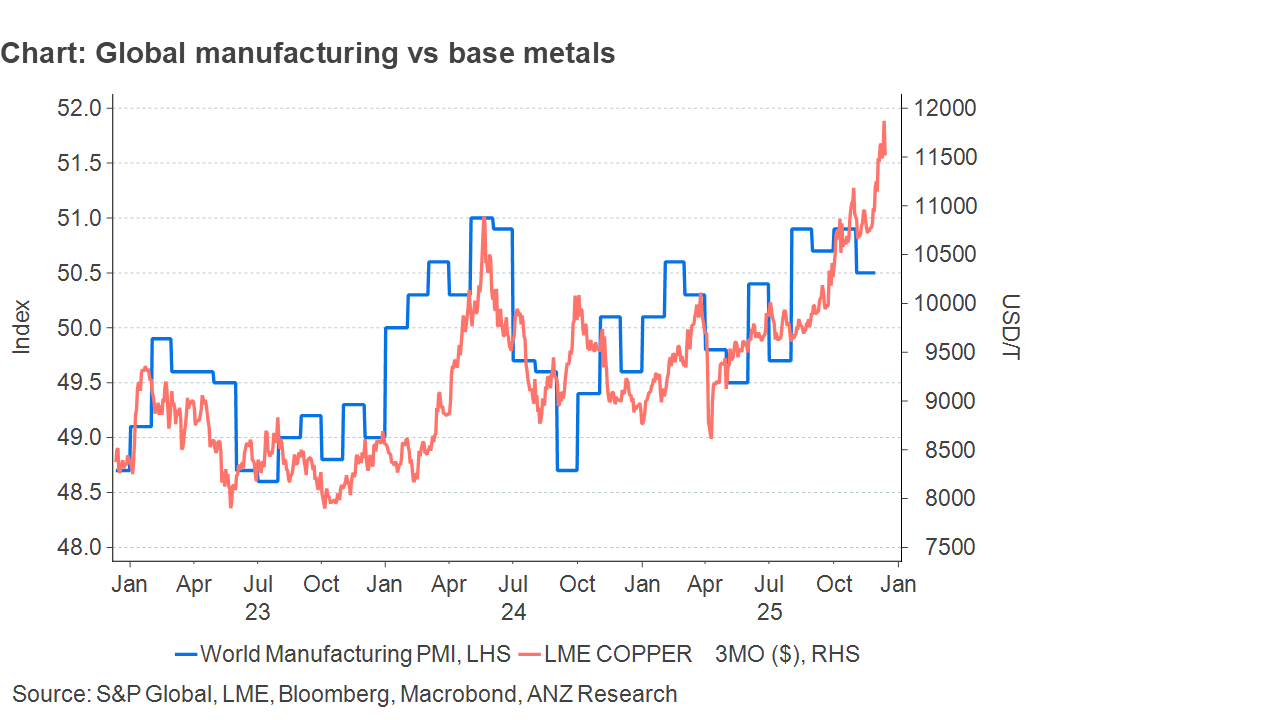

Copper has long been viewed as a proxy for the global economy. It was given the nickname ‘Dr Copper’, because of its ability to predict global economic turning points. This is due to its widespread use in transport, construction, electricity networks and consumer goods. The copper price has followed a similar path to global manufacturing activity. Tighter monetary policy in 2023 saw the manufacturing sector fall into contractionary territory (Figure 16). This was mirrored by a fall in copper prices. The subsequent rebound in 2024, led to a similar recovery in copper.