Commodities Wrap: Copper stabilises on signs of Chinese buying

Tuesday 3 February, 2026

Summary

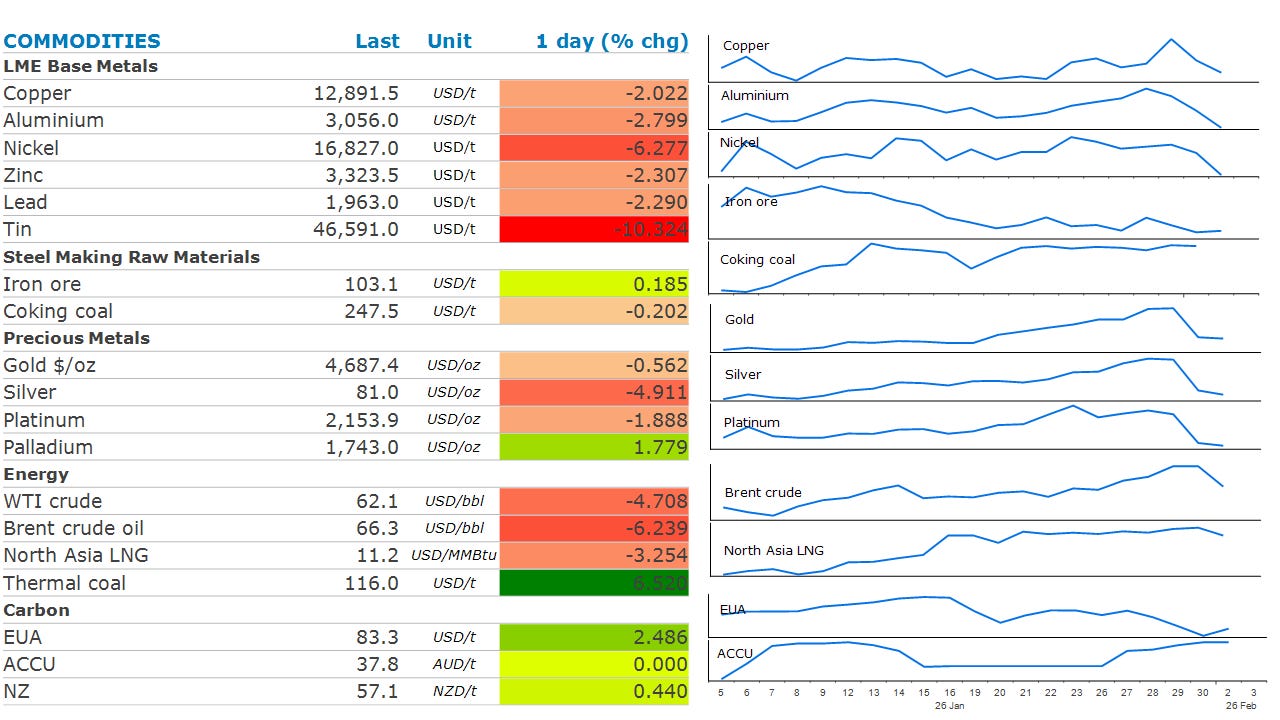

Selling continues across precious and industrial metals. Oil was also lower as geopolitical tensions eased. Natural gas prices fell on the prospect of weaker demand.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: none.

Central bank speakers: Fed Vice Chair for Supervision Michelle Bowman (WSJ Invest Live); RBA Governor Michele Bullock press conference.

Economic data: Australia rate decision; Australia building approvals; Brazil central bank minutes; Eurozone bank lending survey; France CPI; Hong Kong retail sales; New Zealand building permits; South Korea CPI; Spain unemployment; Turkey CPI; Turkey PPI; US vehicle sales; US JOLTS job openings.

Commodities reports: API US oil inventories 16:30 / 21:30 / 08:30+1.

Events: Kuwait Oil & Gas Show (through 5 Feb); LNG2026 Doha (through 5 Feb); World Governments Summit Dubai (through 5 Feb); Argus Americas Crude Summit Houston (through 4 Feb); Indonesia Economic Summit Jakarta (through 4 Feb); Singapore Airshow (through 8 Feb).

Metals & miners: Sumitomo Corp earnings; LME Commitment of Traders (metals positions)

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

The selloff in the precious metals continued as traders unwind bullish bets. Spot gold was down more than 10% at the height of the. A record wave of purchases of call options, which gives holders the right to buy at a predetermined price, set the scene for the selloff. As prices fell, dealers have opted to sell hedges. However, the bulk of that unwind may be done, with gold recovering later in the session to end the day down only 4%. Further stabilisation will be determined by the mentality of the retail market. Physical demand from this sector has been strong in recent months and could provide a strong backdrop to the selling from leveraged trades in the institutional market. Fundamentals remain strong. Central bank gold purchases should be strong amid strained international relations, while concerns about Fed independence and rising risk premiums on US assets may add volatility that supports investment demand for gold through 2026.

The heavy selling in the precious metal sector continued to spill into the base metals market, with copper down as much as 5.7% in Asian trading. However, copper pared back some of those losses on signs of buying from Chinese consumers. Manufacturers, who had been absent from the recent rally, emerged from the sidelines to buy copper at lower prices to help restocking inventories ahead of the Lunar New Year holiday. That is despite economic data showing factory activity remains weak. China’s official manufacturing purchasing index for January fell to 49.3, below the 50 threshold, separating expansion from contraction. The China Federation of Logistics & Purchasing attributed the slowdown to colder weather and demand being pulled forward late last year as firms rushed to meet annual targets. The broader macro picture was also positive. India and the US reached a trade agreement that cuts the tariffs on Indian goods to 18% from 25%. US manufacturing activity also unexpectedly expanded in January, with the ISM index rising to 52.6.

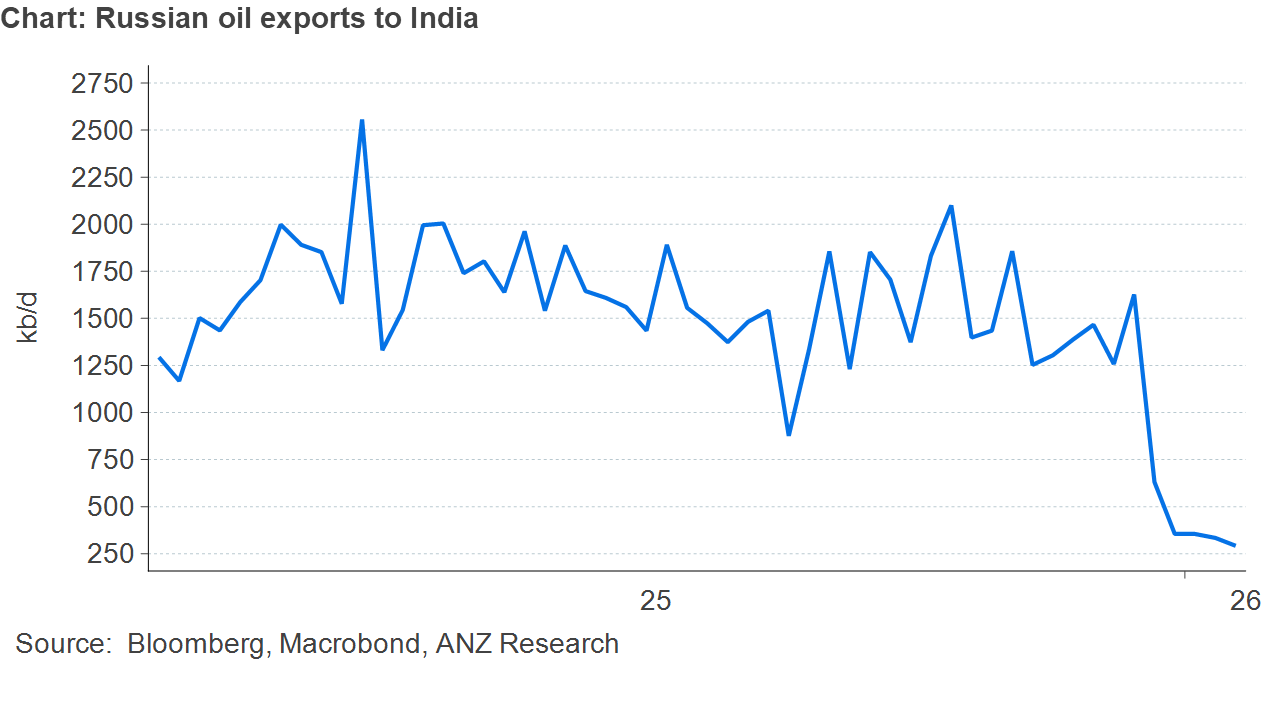

Crude oil extended recent losses as geopolitical tensions continue to ease. President Trump downplayed threats from Iran’s supreme leader, Ayatollah Ali Khamenei, of a regional war, reiterating that he’s hopeful they’ll make a deal. Iran’s foreign ministry said it hopes diplomatic efforts will avert a war. White House envoy, Steve Witkoff, and Iranian Foreign Minister, Abba Araghchi, are set to meet in Istanbul on Friday. Crude oil felt the impact of investor’s retreating from the sector amid the heavy selling in the precious and base metal markets. This was exacerbated by a stronger USD, which weighed on investor appetite. The threat of further headwinds on Russian crude exports also eased following the US-India trade deal. As part of the deal, Trump said he will remove the additional 25% tariffs he applied in response to India’s purchases of crude from Russia. This could trigger more buying from Indian refiners.

Global gas markets were also under pressure amid signs of weaker demand. North Asia LNG prices fell on the prospect of above average temperatures weighing on heating demand. In Japan, such conditions are expected in Tokyo and the wider Kanto-Koshin region. Nationwide temperatures across China are set to be mild, broadly trending seasonal to above normal through mid-February, according to data from Atmospheric G2 and other weather models. European gas futures posted their sharpest fall in two years as forecasts signalled milder weather in coming weeks.

Chart of the Day

India has been a key destination for Russia crude after trade flows were upended by Russia’s invasion of Ukraine in 2022. From virtually nothing. India’s imports from Russia reached over 2mb/d. However, US sanctions on Russia’s biggest oil producers, Rosneft PJSC and Lukiol PJSC, resulted in a sharply decline. Volumes in January averaged only 335kb/d, according to ship tracking data. Its unclear the extent that the additional 25% tariff on India was having on India’s appetite of Russia crude. However, it removes another headwind which should ultimately make it more attractive for Indian refiners.