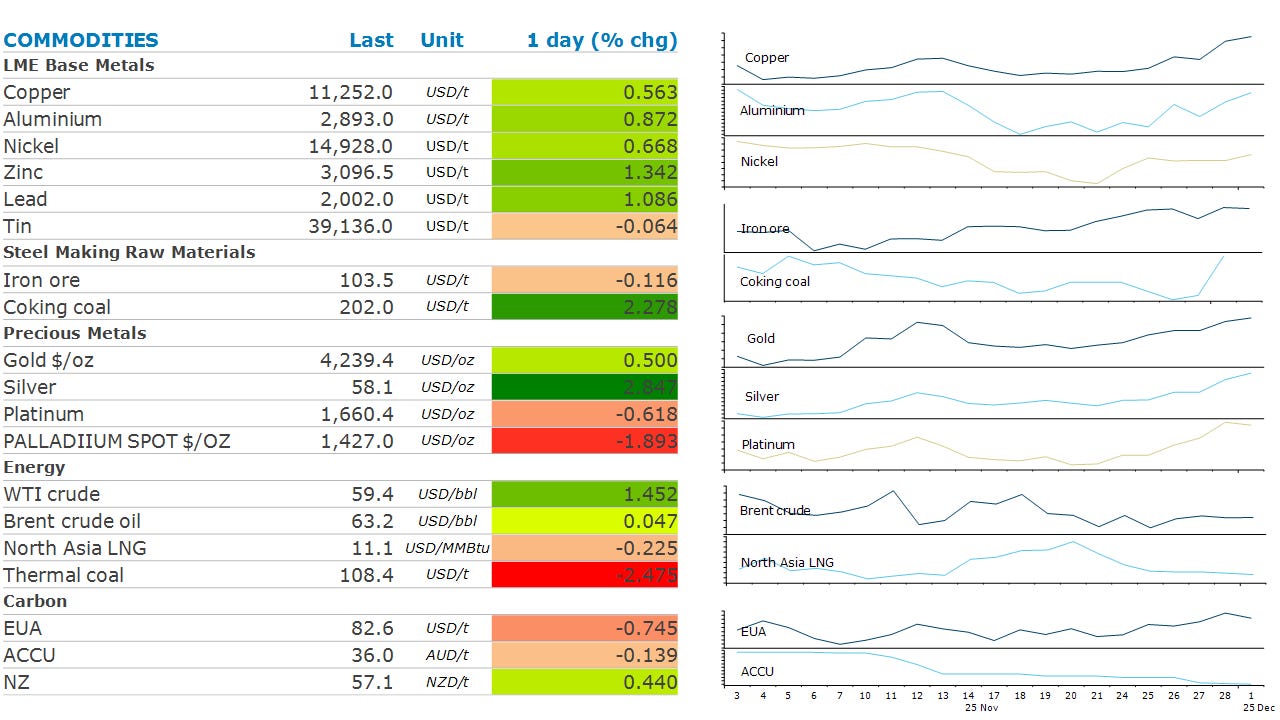

Commodities Wrap: Copper hits record high amid supply shortages

Tuesday 2 December, 2025

Summary

Signs of tightness amid ongoing supply side issues continue to support metal markets. Oil gained following disruption to supply in the Black Sea. Silver hit a record high as concerns mount over supply shortages.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

Public holidays: UAE

American Petroleum Institute’s weekly report on US oil inventories

OECD Economic Outlook report

Vale investor day, London

CFTC weekly commitment of traders data (delayed by the US government shutdown)

LME commitment of traders report

Economic data: Australia current account, building approvals; Brazil industrial production; Eurozone CPI, unemployment; Hungary GDP; Italy unemployment, PPI; Mexico international reserves; South Africa GDP; South Korea CPI; Spain unemployment; US vehicle sales.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Copper rose to a record high, as concern over supply shortages grips the market. Copper is central to the global economy’s electrification and the energy transition and rose by 1% to USD11,295/t on the LME exchange. In the US, copper gained 1.6% as concerns over future tariffs triggered a wave of buying. Several commodity traders have approached Chilean producers to lock in US annual supply deals for 2026, with some paying more than USD500/t over benchmark prices on the LME. Kostas Bintas, head of metals at Mercuria Energy Group, warned that a rush to ship metal to the US risks draining the rest of the world’s inventories. He said more than 500kt could arrive in the US in the first quarter of 2026. There was an industry gathering in Shanghai last week, and supply shortages were high on the agenda. Chinese smelters are facing tough negotiations over annual processing fees, given spot charges are still in negative territory. Data back up these concerns, with Chile’s national statistics agency reporting that October production of copper fell 7% y/y to 458,405t.

Silver jumped to another record high on expectations of supply shortages. Inventories in warehouses linked to the Shanghai Futures Exchange have recently hit their lowest level in nearly a decade. This has seen the cost of borrowing the metal remain elevated. The market is also concerned that the US may be looking to apply levies to imports, after silver was added to the US Geological Survey’s list of critical minerals. Gold edged up, as expectations of a Fed rate cut in December rise. The CME FedWatch Tool now sees a 87.4% probability for a cut to rates at the December meeting.

Crude oil prices rose after a terminal in the Black Sea was damaged. One of three moorings on a pipeline linking Kazakh oil fields to Russia’s Black Sea coast was damaged by a Ukrainian attack. Kazakhstan’s crude exports have averaged 1.6mb/d so far this year. The moorings are said to be severely damaged, according to Bloomberg. Ukraine also confirmed attacks on an oil refinery and tankers over the weekend as it ramps up strikes on Russian oil targets. The US is also widening its campaign against Venezuela, raising concerns that oil exports may be further impacted. This comes after OPEC decided to stick with its plan to pause production increases during the first quarter of 2026 amid growing signs of a surplus in global oil markets. However, the move gives it time to assess the impact of the various supply risks hanging over the market.

Gas prices in Europe and Asia extended losses on signs of strong supply. US LNG exports hit an all-time high in November for the second consecutive month, driven by cooler weather and robust output from the country’s two largest producers. The US shipped 10.9mt in November, up from 10.1mt in October. Europe received 70% of US LNG exports in November, as it fills its storage facilities for winter. The situation remains precarious, with storage levels sitting at only 77%. This is well below the mandated 90% level required by 1 December. Strong US exports may be offset by lower supply from Indonesia. Exports from the Asian supplier have fallen 20% since the start of last week and are now below the seasonal average.

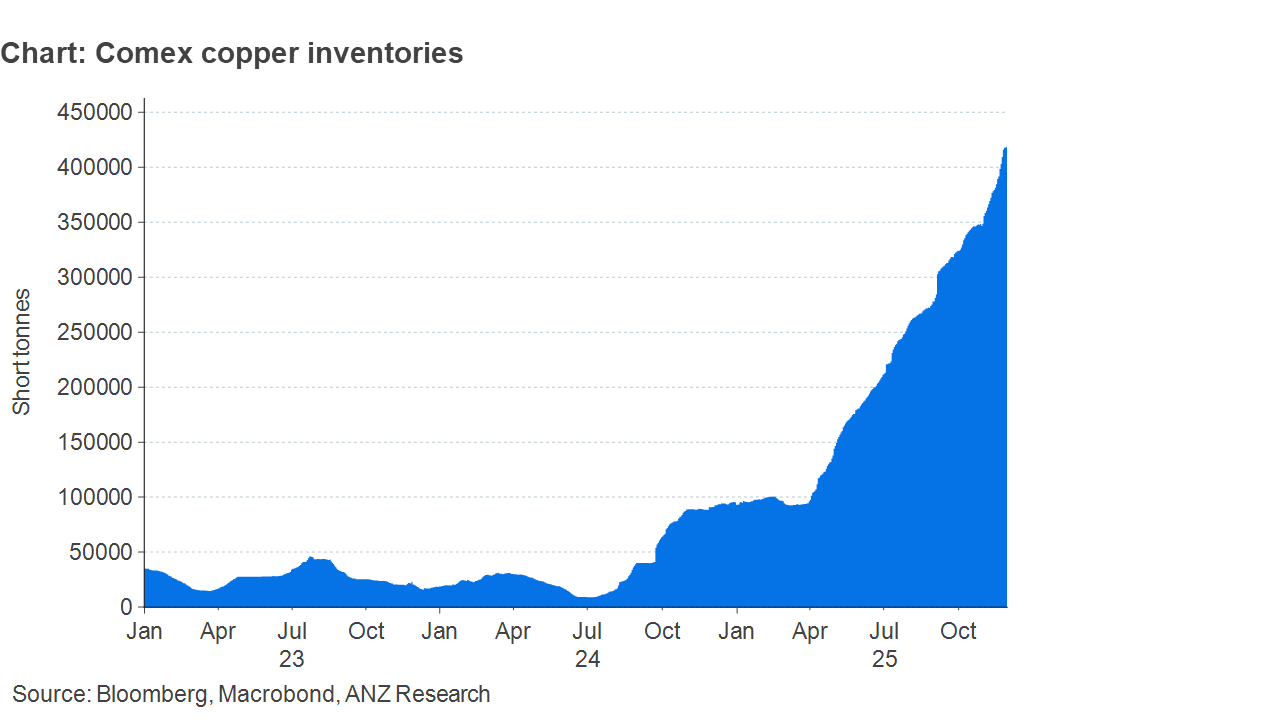

Chart of the Day

Copper inventories in Comex warehouses have risen to a record high 402,876t. This is up 330% over the past year and is now equal to 25% of total US copper demand. This is despite Trump announcing in July that refined copper metal would be exempt from 50% tariffs. A proclamation published by the White House stated that the Department of Commerce delay the imposition of imports tariffs on refined metal, with the rate set at 15% starting 2027, rising to 30% in 2028. However, Trump also directed the Secretary of Commerce to provide an update on US copper markets by the end of June 2026, so that the president could determine whether the phased universal import duty on refined copper would be warranted. This has triggered concerns that the 50% tariff will come in early than planned, prompting the continued surge of metal in the US.