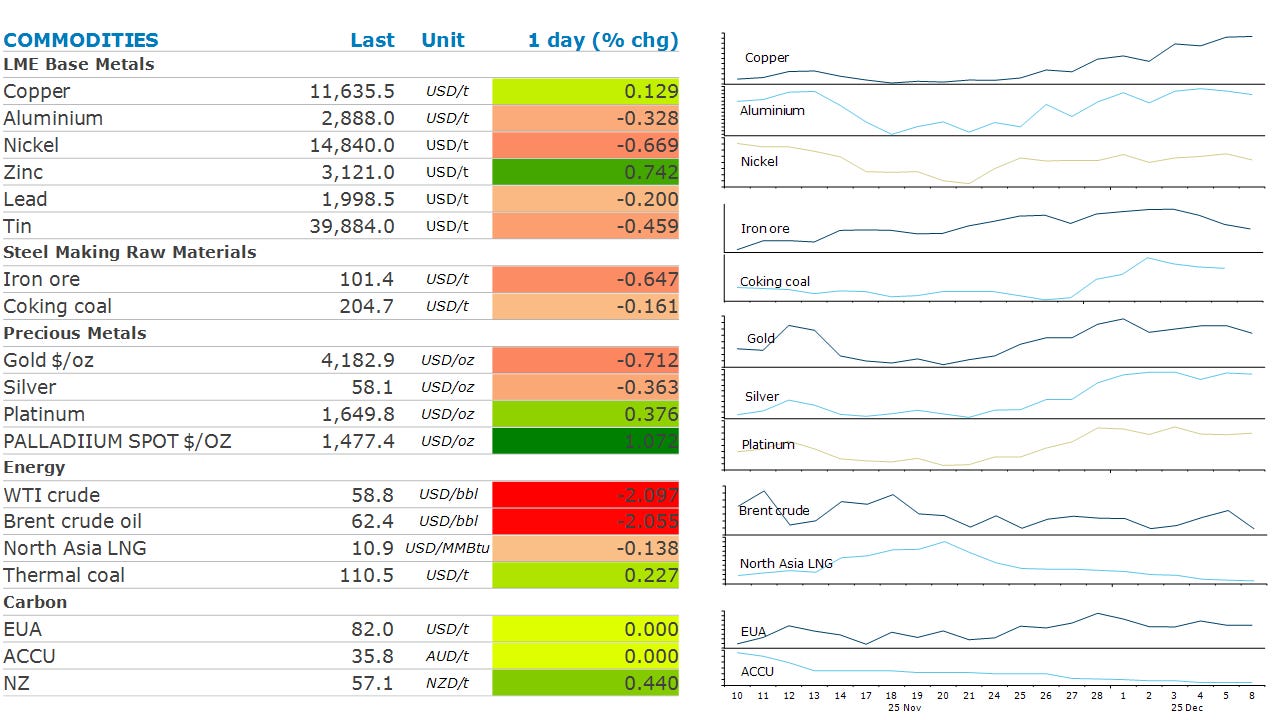

Commodities Wrap: Copper gains amid robust Chinese demand

Tuesday 9 December, 2025

Summary

Copper gained amid hopes of increased demand in China. Gold dipped as bond yields rose. Oil fell amid signs of steady Russian oil flows.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

American Petroleum Institute’s weekly report on US oil inventories

EIA Short-Term Energy Outlook

RBA rate decision

Central bank speakers: Nagel (ECB); Ueda (BOJ)

CFTC weekly commitment of traders data

LME commitment of traders report

Economic data: Argentina industrial production; Australia rate decision, NAB business confidence; Chile trade; Japan money stock, machine tool orders; Mexico CPI, international reserves; Taiwan trade; Ukraine GDP, CPI; US JOLTS job openings

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

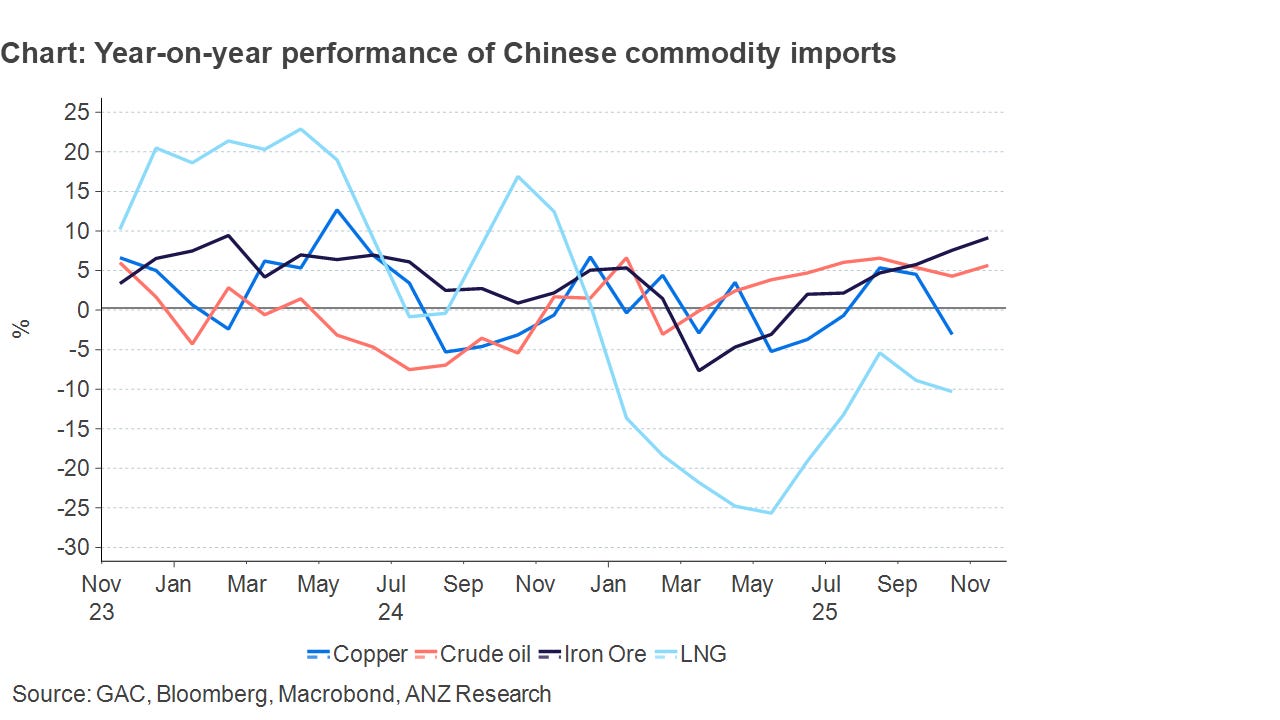

Copper rose to another record high on the prospect of stronger demand in China. China’s Politburo announced that it would stick with a proactive fiscal approach and maintain a “moderately loose” monetary stance, after recent data showed a slowdown in economic activity in Q4 2025. Fixed asset investment shrank 1.7% in the first 10 months of the year. Industrial production rose by 4.9% in October, the smallest gains since the start of the year. However, trade data for November was more positive. Exports rebounded to beat estimates and push the country’s trade surplus past USD1trn for the first time. Demand for copper was also stronger. Refined copper was impacted by unfavourable import arbitrage, with imports declining by 19% y/y to 430kt. Trade flows are being diverted to the US due to fears of impending import tariffs. However, copper ore imports rose 13% y/y to 2.53mt.

The prospect of further fiscal stimulus failed to boost sentiment in the steel and iron ore markets. Futures in Shanghai fell amid concerns of rising inventories. Total stockpiles at Chinese ports rose 2.4% last week to 142.4mt, according to Steelhome, driven by strong imports which remained robust in October. Total volumes were at 110mt, up 9% y/y. Mills continue to actively restock, even as the “anti-involution” campaign creates headwinds. This is being driven by strong demand for steel in international markets. China’s exports of steel are on track for a record in 2025, with year-to-date volumes already well over 100mt for the first 11 months of the year. Nevertheless, with domestic steel output sharply lower and iron ore port inventories recovering, imports are set to decelerate.

Gold slipped as bond yields pushed higher as traders look to 2026, beyond a near-certain rate cut at the Fed’s December meeting. Kevin Hassett, a leading candidate to take over the role of Fed chair, said it would be irresponsible to lay out a plan for rate cuts over the next six months. Central bank buying remains supportive. The People’s Bank of China added to its gold reserves for the 13th straight month. According to official data, it now holds around 74.12moz of gold in reserves.

Crude oil prices fell amid signs that Russian supplies will remain elevated. President Putin promised uninterrupted shipments of oil to India, despite sanctions. The focus on Russia’s oil supplies comes as the US presses for a Ukraine-Russia peace deal. Trump said he was disappointed in President Zelenskyy’s handling of the US proposal to end the nearly four-year-old war. Elsewhere, strong Chinese demand for oil failed to boost sentiment. Crude oil imports rose 5% y/y to 50.89mt, marking the second-highest monthly imports this year. Improved refining rates and lower prices led to robust purchases, despite tighter sanctions against Russian oil. The latest announcement of increased import quotas for private refineries is expected to keep imports resilient.

European gas ended the session lower as weather forecasts pointed to a longer stretch of mild weather. Winter temperatures have remained well above normal for much of the European mainland. In addition, strong winds have boosted renewable energy output, curtailing the need for natural gas. North Asia LNG prices fell to their lowest in over a year, as the region’s top importers are well supplied for winter.

Chart of the Day

China’s commodity imports for November remained strong despite subdued industrial activity. Lower prices helped boost purchases of energy and iron ore. Stockpiling of iron ore offset the seasonal decline in steel production and construction activity.