Commodities Wrap: Copper falls amid signs of softness in China

Wednesday 3 December, 2025

Summary

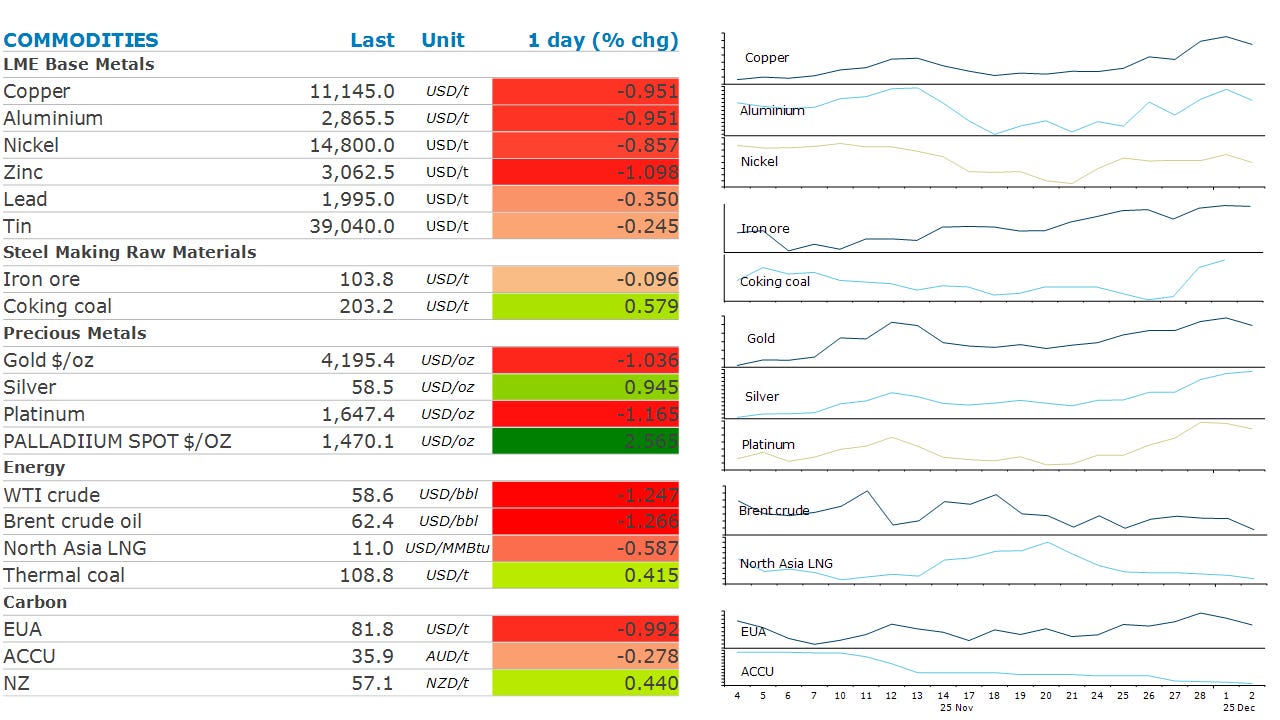

Geopolitical risks continue to hang over energy markets. Oil declined despite Russian oil struggling to find buyers due to US sanctions. Metals were mixed amid signs of weakness in demand in China.

Prices and commentary accurate as of 07:00 Sydney/05:00 Singapore/17:00(-1d) New York/22:00(-1d) London.

Ahead Today

FT Commodities Asia Summit, Singapore (thru 4 Dec)

EIA weekly report on US oil inventories, supply and demand

Glencore capital markets day

EU member states due to discuss state of negotiations on the 2040 climate target

World LNG Summit, Istanbul (thru 5 Dec).

NATO foreign affairs ministers meet in Brussels

Central bank speakers: Lane (ECB); Mann (BOE)

Economic data: Australia GDP; China RatingDog services PMI; Eurozone HCOB services PMI, PPI; Poland rate decision; Russia unemployment; South Korea GDP; Switzerland CPI; Thailand CPI; Turkey CPI; US industrial production, ADP employment change, ISM services index, mortgage applications.

Listen to today’s 5in5 with ANZ podcast for more on the global economy and markets.

Market Commentary

Crude oil finished lower following a choppy session, as geopolitical tensions roiled the market. US envoy, Steve Witkoff, arrived in Moscow to meet President Putin to begin talks about a potential peace deal to end the war in Ukraine. Tensions built after Putin threatened retaliatory measures on vessels from nations helping Ukraine, according to Interfax. Over the past week, four Russian oil tankers have been attacked, a sharp up-tick in strikes on its ships. US sanctions on Russia’s oil industry appear to be making it difficult for the OPEC+ alliance member to deliver its oil. While Russia has maintained shipments comfortably above 3mb/d, offloading cargo has become more difficult. The average voyage time for ships travelling between Russia and China is up by 50% to 12 days. This has seen a sharp increase in the amount of Russian oil on tankers at sea, which topped 180mbbl at the end of November. Geopolitical risks are also rising around potential US military action in Venezuela that could threaten the latter’s oil production of just under 1mb/d.

North Asia LNG price hovered around USD11/MMBtu amid soft demand from some of the region’s biggest importers. Major consumers such as Japan and China have likely locked in the fuel they will need via long term contracts. Korean importers have also largely completed procurement for winter. European gas futures edged lower as ample supply eased concerns of shortages over the heating season. US LNG exports, which predominately find their way to Europe, hit an all-time high in November for the second consecutive month. The US shipped 10.9mt in November, up from 10.1mt in October. The continued rise should help Europe meet demand over the next few months, despite storage levels sitting at only 77%. This is well below the mandated 90% they were required to reach by 1 December.

Copper retreated from a record high amid signs of softer demand in China. Demand tends to weaken as winter arrives, with fabricators said to pull back on orders in recent weeks. This will make more Chinese metal available for exports. In another sign of slowing demand for imported metal, the Yangshan copper premium, which traders pay to import copper into China, has dropped to its lowest level since July. According to Shanghai Metals Market, China’s leading copper smelters have agreed to cut production by more than 10% in the coming years. This comes after a collapse in processing fees, which smelters receive for refining copper ore into metal. These fees have been in negative territory for several months, which has seen China’s smelter industry running at a loss.

Gold retreated during the session, as safe haven buying eased. Recent gains also elicited some profit taking, with the precious metal closing session down nearly 1%. Physical demand remains strong. ETFs increased their gold holdings for the fifth consecutive day, adding 194,788oz. This marks the biggest one-day increase since 21 October. Silver also fell on signs the six-day rally had run too far. Technical indicators suggested the metal have moved into overbought territory.

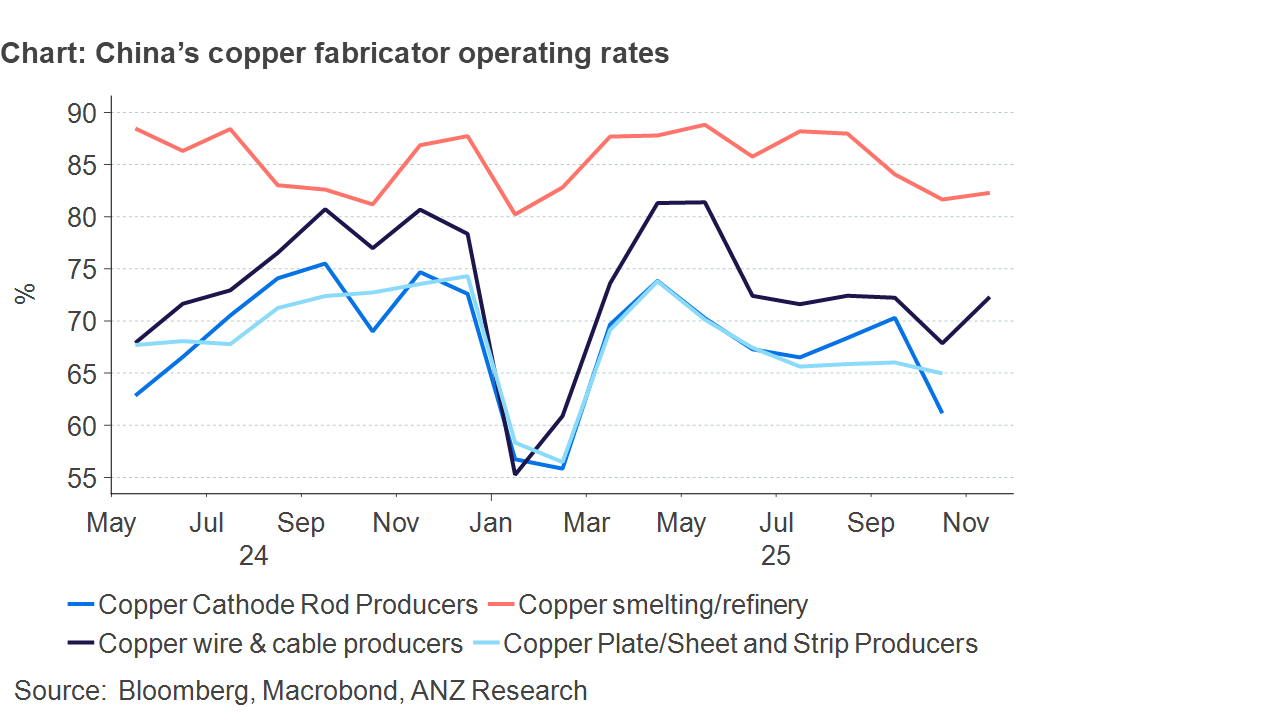

Chart of the Day

China’s investment in its power grid and clean-energy technologies is bolstering demand for copper. However, there are some signs of demand weakening in the near term. Industrial and manufacturing activity fell sharply in China in October. This is being reflected in the copper market, with operating rates at Chinese fabricators falling in recent weeks. Copper cathode rod producers are now operating at only 61% capacity, compared with 74% in April.